Download the PDF.

In this essay I shall try to answer three questions.

(a) What are the factors responsible for the striking acceleration, during the last decade, in the growth of the outstanding debts of the Third World in general and, more especially, of those under-developed bounties which do not export oil ?

(b) What effects has this indebtedness had on the national economies of the debtor countries?

(c) What can one reasonably foresee concerning the future of these debts?

The origins of the over-indebtedness

An obvious turning-point in the evolution of the Third World’s outstanding debt occurred in the early 1970s, and particularly in 1974, the date of the first “oil shock”, What had till then been just a debt became thereafter a debt problem.

This “break” is reflected first of all in the comparative growth-rates of the outstanding debt – from about 14% in the 1960s to about 22% in the 1970s. But besides the results of comparison between the annual averages of the growth-rates – results which, moreover, an IMF study using special “deflaters” tends to modify substantially, and even to invert — the change of pace is reflected when we make comparison between the variations in the growth-rate within each of these periods.[1]

When, indeed, a country starts with a growth-rate of indebtedness which is already higher than the rates of the basic indicators of the economic “potential” gross domestic product, foreign trade, etc. – but which, owing to the low level of the absolute magnitudes involved, does not yet constitute a problem, the mechanism of compound interest will soon cause an explosion, even if the growth rate of indebtedness does not vary, or if it decreases only to an insufficient degree. As we see, however, from the diagram which follows, this rate declined markedly during the first decade but then increased, also markedly, in the second.

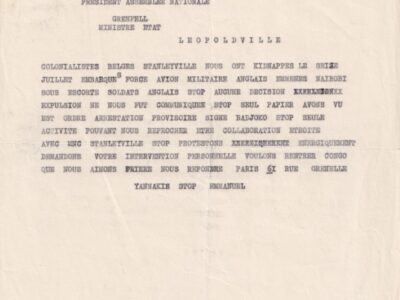

Sources: Graph based on figures in the reports of the World Bank for 1969 and 1971, on the one hand, and, on the other, on the O.E.C.D. 1982 study: “External indebtedness of the Developed Countries.”

If one compares, instead of the growth-rates of the outstanding debt, those of the growth in the service of the debt, the results are even more eloquent: 9.5% for the period before the “oil shock”, 27% for the period after it. But a calculation in terms of service of the debt is not in itself quite relevant, because it’s redemption component is, in the last analysis, only a problem derived from that constituted by the interest component, the re-scaling of payment becoming difficult only when new loans exceed the amount to be redeemed, and are needed to supply the interest on the old loans. (Ultimately, every debt problem comes down to a problem of interest-payments. If you are able to meet those regularly, when they fall due, you have nothing to worry about as regards the principal. The market will bail out those of your creditors, if any such there be, who demand recovery of their principal, and which does not have to be repaid.)

On the plane of interest-payments the turn from one period to the other is even more dramatic. The annual average of the growth-rate of the mass of interest grew from about 12% before to about 31% after. This clearly expresses the combined effect of the two additional charges – that of the outstanding debt and that of the rate of interest.[2]

It is therefore undeniable that if excessive indebtedness exists, it is due to the impact of the “oil shock”. But this does not mean that the indebtedness in question is due entirely to the oil-bill. That item accounts for only about half of it. The other half was incurred in the financing of imports other than oil — very largely, imports of intermediate goods and equipment, from the OECD countries mostly, the rest coming from the socialist countries. All this was fed by the banking super-liquidity engendered by the external “saving” of the oil-exporting countries, or, in other words, by that part of the bill due to them which was “not paid” in equivalent imports.

It is owing to observation of this fact that a controversy has recently begun, on the question whether the responsibility for over-indebtedness lies with the big international banks, which may have gone too far in trying to invest their petro-dollars, or with certain “strategies” and “modes of accumulation” on the part of the borrowing countries which have led, by their own logic, to the creation of deficitary external balances.

On the first of these points, a certain consensus seems to have emerged, in favour of the thesis which ascribes only a permissive role to the conjunctural superabundance of lendable funds.[3] On the second point, however, a large number of explanations have recently been formulated, which, in variants differing more in in words than in substance, see in the indebtedness under consideration a direct consequence of the inegalitarian model of development (called the “excluding” model) which has been adopted almost everywhere in the Third World, and especially in Latin America. (Translator’s note: “Excluding” means, here, “excluding the majority of the people from the blessings of consumer society.”)

While the first point does not seem to give rise to many objections, the second seems, to me to be quite flimsy. Inegalitarian distribution is a corollary of all industrialisation in its early stages and is in no way an untypical “model” which is specific to the Third World or to the Latin America of today.[4] Through its effects in shrinking the market and withering opportunities for investment, it is a factor which blocks development. But that is not what matters here. In the countries we are discussing, it is not encouragements to invest that are lacking, but means to invest. Despite the shrinking of consumption through the inequality of incomes, far from having an excess of internal saving which paralyses investment for lack of outlets, what we have seen, on the contrary, for special reasons — the appearance of “anticipated outlets” as a result of a massive transfer of industries and techniques — which I cannot analyse here, is an explosion of investment, calling upon external saving and utilising this by way of the incurring of debts.

Under these conditions, if the system were more egalitarian, the transfer of income from the classes and strata with a higher propensity to save — capitalists or high and medium wage-earners — to classes and strata with a lower propensity to save would have expanded the market and stoked up still higher the “craving” for investment, while at the same time reducing the means available for it, and would consequently have led to a still bigger call upon external saving, and even heavier indebtedness.

As to the idea which underlies this view of the matter, namely, that inequality of distribution shifts investment from the sphere of goods of mass consumption to that of consumer durables, the production of which is said to necessitate more imported equipment and, consequently, more external financing, its authors have simply forgotten to look at the statistics. Had they done that, they would have noticed that the branches of production in which consumer durables are made have, as a rule, a lower intensity of fixed capital (and in the branches making capital — goods it is still lower) than those which make non-durables.

More original, in terms of “strategy”, and so more interesting, is the thesis of Rabah Benakouche, who points to a deliberate policy on the part of the rulers of the countries in question which tends, out of exaggerated nationalist directed against direct foreign investment, to encourage loan-capital while discouraging risk-capital.[5]

I have no grounds for doubting the historical fact invoked by this study. When we think of the universal hue-and-cry against the multinationals in recent years, it is plausible that authoritarian governments in search of legitimacy may have, here and there, resorted to the excuse of “rejecting dependence” or preferring to finance particular projects by borrowing rather than than allowing the installation of a branch of a multinational concern. But did they really have a choice? When we put side by side the orders of magnitude of direct investments, on the one hand, and on the other, those of indebtedness, we may well doubt it. Between 1970 and 1981 the total sum of net transfers for all the non-oil-exporting developing countries, by way.of direct investments, amounted to about 11 milliard dollars. During that same period the net transfer by way of borrowing — new borrowings less service of the debt, or increase in outstanding debt less interest — amounted to about 233 milliard dollars.

Besides, not all the developing countries have shied away from direct investments: far from it. Yet none of these countries has ever succeeded in attracting risk-capital in amounts comparable to loan-capital, however generous the advantages and privileges granted to the former.

The truth of the matter is simpler. Through the mere fact of underdevelopment of the productive forces, and, consequently, of smallness of the domestic product, internal saving is insufficient to permit accelerated growth. It is not the “mode of accumulation” that matters (assuming that there are different “modes”, which I doubt), but the quantities accumulated. The global needs for financing exceed by far the world’s transferable capital. It is therefore the latter which constitutes the limiting factor. The underdeveloped country, whatever its philosophy or “strategy” may be, is ultimately obliged to accept whatever it can get from this capital. As Elsenhans pointed out at the end of the GREITD colloquium, already quoted, indebtedness is too universal a phenomenon for it to be related to the peculiarities of the internal policies of the debtor countries.[6]

But it is not enough, either, to point to the Third World’s need of resources, on the one hand, and the influx of surplus payments for oil into the banks of the West, on the other, in order to explain the unusual volume of the transfer of resources during the last decade.

First, and above all, if we regard this transfer as unusual, it is because we are comparing it with what went on in the recent past. If we were to go further back, we should find that the centrifugal mechanism which pours out the surplus of the “centre” into the “vacuum” of its periphery is as old as the capitalist system itself. I have already had occasion to write elsewhere about this transfer of resources which so enables the receiver to catch up with the giver by accelerating development — from Northern Italy to Holland, from Holland to England, from England to North America, and so on.[7]

These transfers stopped abruptly when classical capitalism was replaced by the “consumer society” and when, therefore, egalitarianism at the center started to coexist with increasing inequality internationally and the exploitation of the periphery by the center. Capital could then find at home all the outlets it desired, and centripetal forces replaced the centrifugal mechanisms of the earlier period. Capitalism, which seemed moribund, was able to recover its youth by profiting simultaneously from low wages in the periphery and high wages at the center. The devastating crises of the past, with unemployment at a rate as high as 30% of the active population, were forgotten.

This does not mean that the system had overcome its contradictions for good and all, but it does describe the situation it was in when the unexpected intervention of a monopoly held by the periphery, that of oil, suddenly altered the rules of the game.

This alteration was materialised not through the burden on the terms of trade represented by the bill for oil, but through the partial transformation of this payment into financial claims. In fact, as a result of their very underdevelopment, the oil-exporting countries lacked the power of absorption needed to “pocket” their bill in real values.

This “super-saving” by the oil-exporters had, in the main consuming countries, a dual deflationary effect, both direct and induced. Direct through the actual deficit in their trade balances, and induced, through the measures of protection and austerity taken by these countries in their efforts to pass on to each other this deficit, whether actual or expected.

Finally, to the two factors already mentioned – a Third World whose crisis was one of shortage, not of overproduction, and a sudden swelling of mobile international funds – must be added a third. For the first time since the last war, opportunities for investment were lacking in the large industrialised countries, whereas a restructuring of the international division of labour and an exceptional fluidity of techniques created such opportunities in the developing countries.

Thus, in the triangular process of compensation which followed, the three parties all got what they needed. The industrialised countries partly made up the deficit in their exchanges with the oil-exporting countries thanks to the surplus-payments which they managed to realise with the non-oil-exporters. The latter were thus able to increase their investments and maintain high economic growth-rates despite the world crisis. Finally, the oil-exporting countries were able to invest the dollars which their poverty prevented them from realising within their frontiers, and under the best possible conditions, since this “triangle” enabled them to have as guarantors of their dollars the Citicorp or the Bank of America, instead of Brazil or Zaïre, as would have been the case had they “re-cycled” them themselves.

A technical factor constituted the cement in this combination, namely, the existence of an international money of credit. It is hard to imagine what would have happened if the monetary system of former times had been in operation, the system under which differences in trade balances were settled through physical transfers of gold. At the official rate of the period, $42.22 per ounce, all the reserves of all the O.E.C.D. countries put together would not have sufficed to pay that part of the oil bill not covered by exports, and even at the free market rate at the end of 1974, about $ 180 per ounce, these reserves would have been exhausted, down to the last ingot, after three or four years. What has made possible this fantastic movement of funds, and thereby enabled the system to function, come as may, is the replacement of gold by accountable entries.

Like every living organism, the capitalist. system reacts to “shocks” by creating ad hoc antibodies. This does not signify that it is immortal: no living organism is that. But it does show the mistake made by some analysts who take the agents of a survival which is real for the ferments of a death which is not.

The effects of indebtedness

Asking about the effects of indebtedness means, in fact, asking what the funds borrowed were used for. Because the “entries” I have mentioned are not merely items of account: represent a real counterpart, namely, the unilateral flow of goods towards the debtor countries.

In this connexion there has been talk of money-capital. Actually, this is not money-capital. It would have been money-capital if the funds borrowed had served merely to top up the reserves held by the borrowers. But only a small part can be ascribed to that use, namely, 41.4 milliard dollars, for this same period 1970-1981 and for all the non-oil-exporting developing countries. In the same period, the accumulated deficit in the trade balances of those same countries was 380 milliards (329, if we include in it non-financial services) , or eight times as much.[8] On the other hand, the outstanding debt (amounts paid in) increased from 50 to 450 milliards, in round figures.

Since, in addition, there are other inflows on the resource side – direct investment, public aid which imposes no burdens, transfers from expatriates, and so on – which have contributed to the financing of the trade deficit and the increase in reserves, we can, in a very synthetic way, draw up the following, balance for the period 1970-1981:

| External resources | In milliard dollars |

| Net transfer of loans of all kinds (Increase | |

| in outstanding debt less interest) | +233 |

| Net transfer of directinvestments (new | |

| foreign investments less repatriated | |

| dividends) | +11 |

| Other unilateral net transfers | + 126 |

| + 370 | |

| Uses made | |

| Accumulated trade deficit | |

| (including non-financial services) | -329 |

| Increase in reserves | -41 |

| -370 |

(Based on data from UNCTAD 1983, OECD 1982 and IBRD)

Given the heterogeneity of the different balances used and the uncertainty even of some of the primary data — let us remember the unusual frequency of the entry: “errors and omissions” – this account should not be taken as more than a scheme that shows orders of magnitude.

Let us leave aside the reserves, since these are only claims on the banks of the lending countries, and therefore liable to be frozen in the event of a moratorium proclaimed by the borrowers. To be correct, we ought even to deduct them from the outstanding debt rather than include them among the uses made. What, ultimately, has to be grasped is that more than 300 milliards of real external resources have been put at the disposal of the non-oil-exporting developing countries is the period under examination, financed by borrowing to the extent of about 70%.

Even if this influx of goods served only to stimulate additional unproductive consumption, the fact of the unilateral transfer of value from one group of countries to the other would remain valid. The sole rationality of today’s: “productive consumption” is to increase tomorrow’s “unproductive consumption”. While it is hoped that this future consumption will be lasting, whereas that which is being renounced for the present is only temporary, the latter is, for all that, not without significance. One would still have, of course, to see the extent to which each category of citizens benefited from it. Nevertheless, this extent is predetermined by the allocation of consumable income within the country under consideration, and is not directly linked with the fact of indebtedness.

But this is not the case, either in theory or in practice.

In theory, because, while an inflation of purchasing power within the country can provoke a surplus of imports, there is nevertheless no mechanism by which surplus imports can be the cause and surplus consumption the effect. In a market economy we import what we consume and as much as we consume: we do not consume because and to the extent that we import.

In practice this is not the case, either, because the imports of the countries in question, during the period under consideration were far from being made up solely of consumer goods, and also because investments in fact increased, and to a substantial degree, in these same countries and this same period.

If we take, for example, three countries which are among the most heavily in debt – Argentina, Brazil and Mexico — we note that by far the largest part of their imports consisted of goods for “productive consumption” es intermediate and capital goods.[9]

But the composition of imports in terms of use-values is only a simple “pointer of supposition”, and certainly not a measure or a limit of the actual additional investments due to imports. If, as has been said earlier, a country’s incomes and rate of saving are given, then, mathematically, the value of the surplus of imports can only feed an equivalent additional investment, even when the physical content of the imports consists of sweets and artificial flowers. (This is so, not because mathematics magically transform sweets and flowers into machines and equipment, but because, if this was in fact the situation, it would mean that this particular composition of imports resulted from the displacement of a corresponding quantity of factors from sector II to sector I, within the country concerned. In other words, this “school example” describes a situation wherein the sweets and flowers are transformed a into machines by nourishing and giving pleasure to the workers who produce these machines.)

We must thus look directly at what has happened in the countries in question, on the plane of accumulation. And here there is no room for doubt. As the OECD study of 1983 observes:

“…these resources…have not served to finance consumption, but have brought to completion an increase in domestic saving by about 2% of the gross national product during the 1970s. External and domestic saving together have financed an increase in the rate of investment — from 20 to over 24% of the GNP – which thus exceeded, for the first time, the level prevailing in the OECD.[10] Thanks to this vigorous investment, the average growth-rate in the period 1975-80 was 5%, that is, two points higher than in | the OECD zone.”[11]

Comparison in terms of growth-rate of investment gives us, further, the following table:

| Real rate of growth of gross investment | ||||||

| in % of the previous year | ||||||

| 1960-70 | 70-78 | 79 | 80 | 81 | 82 | |

| All developing countries | 7.2 | 10.2 | 2.7 | 6.5 | 2.9 | -5 |

| Latin America and West Indies | 6.4 | 7.1 | 4.2 | 9.5 | -0.9 | -16 |

| Industrialised countries | 6.8 | 2.3 | 4.9 | -2.7 | -0.2 | -3.1 |

(World Bank report, 1983)

Of course, none of this pre-judges the future. Already, in 1981, as may be seen from the table above, the upward movement was checked, in the wake of the world recession. (The same thing happened shortly afterward to the rise in external flows). But the earlier result of these flows is an established fact.

Be it added that this result was obtained despite the fact that half of the resources of which the OECD speaks were only nominal, since, as had been pointed out above, where fuel was concerned, this half represented not an increase in quantity but an increase in price. Actually, in the same period (1970-1981), the terms of exchange of the countries in question worsened by 32.44%, mainly as a result of the increased cost of imported oil.

This does not affect evaluation of the opportuneness of the resort to borrowing, since imports of fuel were more or less irreducible and, whether or not they got into debt, the non-oil-exporting Third World countries had in any case to suffer the increase in its cost. But the point arises conveniently to clear up a misunderstanding which have been prompted by my arguments so far. The unilateral transfer of value towards the Third World in the 1970s does not mean that the latter has become a net recipient of wealth from the industrialised countries and has thus ceased to be exploited by them. As I have already explained in other writings, there are, as I see it, two vehicles of value-transfer (and so of exploitation) between countries, and only these two: the explicit vehicle of disequilibria in trade balances at existing prices, on the one hand, and on the other, the implicit vehicle of the “truth” of these prices themselves.

The first vehicle functioned fully, in the direction of South-to-North, in the case of rentier Britain in the period 1870-1914, whereas at that time the second vehicle was insignificant or secondary. It was this second vehicle however, which operated, still in the direction South-to-North, after that period and right down to the “oil shock”, while the first vehicle, in its turn, became insignificant (in either direction). Finally, since the “oil shock”, explicit transfer by balances has again become important, but now in the direction North-to-South, whereas implicit transfer by dual factorial terms of exchange continues to operate in its traditional direction South-to-North — at least so far as the non-oil-exporting countries of the South are concerned. The windfall of the explicit transfer in this last period has certainly done no more than compensate, and that only very partially, the tapping of their resources to which the countries of the South are subject through the implicit inequality of exchange. But this transfer does exist and there is no point in denying it.

Repayability

Up to now I have not dealt with the prospects for repayment of the Third World debts. Actually, I regard this question as being irrelevant so far as the borrowing countries are concerned. What matter are flows and not legal entitlements or positions of accounts at a given moment, since, all things considered, these legal battles can be of interest to us only as generators of flows, either present or future, we may, as well deal directly with the flows.[12]

Accordingly, I have left aside the question of the real rate of interest (corrected for inflation), which, as is well known, has been positive (slightly) only since 1981. I have considered it pointless to analyse the rate of interest since, not only has there not been, up to now, any actual payment of interest, but the increase in the outstanding debt regularly exceeds the capitalisation of this interest. Moreover, it is this surplus which constitutes the “net transfer” on which I am concentrating.

If the capitalised interest of today were one day actually to be paid, that would mean a reversal of the explicit flows, and then they would have to be studied as such, for their effects thereafter, and not just as a consequence of today’s indebtedness. Why? Because these flows are determined, in quantity as well as direction, independently of the level of the financial positions of accounts at a given moment, that is, the assets and credits existing on one side of the other.

We have to understand that one thousand dollars passing from country A to country B, as collection of a coupon or a dividend which a citizen of B has gained in A and is repatriating to B, differs in no way from a new capital of one thousand dollars which a citizen of country A possesses and expatriates to B. In both cases what is involved is a surplus created in A and invested in B, and so, an export of capital, pure and simple. The conventional terms of “repatriation”, in the first, case, and “expatriation” in the second have: no specific meaning. They depend on the viewpoint of the observer. Capital has no fatherland.

This is no conceptual nicety, but goes to the heart of reality. For the conditions which cause the capitalist of A to “expatriate” his capital are exactly the same as those that cause the capitalist of B to “repatriate” the fruits of his capital, instead of investing them on the spot: absence of opportunities in A, presence of opportunities in B. Besides, no present capital is anything other than the fruit of a previous capital.

Quite apart from the matter of indebtedness, for the direction of flows to be reversed it would be necessary that the Third World country should change from being an importer of capital to being an exporter thereof. If this change has indeed taken place, it will be of no advantage to the country concerned that it is not in debt. The flight of its own capital will cause the same drain of substance as would have resulted from repayment of the capital of others. If, however, this change has not taken place, that is, if the country continues to offer better opportunities for investment than exist elsewhere, then the foreign capitalist will reinvest his coupons and dividends on the spot and there will be no drain. In neither case is indebtedness a problem for the borrowing country.

But there is more than the driving-force of the movement of capital to be considered. There is also the vehicle of this movement, namely, an explicit inequality in the trade balance. Except for variation in reserves (which, as we have seen, is marginal) a net transfer of funds from one country to another corresponds strictly to a surplus of exports over imports. It therefore has to pass through the pipe-line of current commercial (and not financial) exchanges. Yet this pipe-line has only a very limited capacity. As Keynes pointed out, international trade has a certain intrinsic rigidity which makes materially impossible any transfer of funds that goes beyond certain amount.

In normal times, the gap between exports and imports is very small, of the order of one or two percentage points, if we take groups of several countries together. In the case which concerns us here, though, the magnitudes involved are of a different order. To ensure the service of their debt without having to contract new loans – the other financial flows being presumed equal – the non-OPEC countries would today need to have a surplus of about 110 milliards every year, for ten years, instead of their present deficit of about 90, that is, would need to make an improvement of about 200 milliard on a consolidated global trade balance (intra-group exchanges excluded), for 1981, of 202.5 milliard in exports and 290.3 milliard of imports, distributed thus:

| OECD | Socialist countries | OPEC | |

| Exports to | 164.3 | 17.8 | 20.4 |

| Imports from | 196.3 | 29.7 | 64.3 |

(UNCTAD, 1983)

We see at once that the prospect of an “improvement” of 200 milliards on this foundation is quite fanciful. Even if the countries in question had to meet only the interest-payments, the principal being renewed ad infinitum, they would have to achieve an “improvement” of 140 milliards per year: interest 50 plus present deficit 90. The quantitative upheaval would still be out of all proportion with their present trade figures. Only a radical change in unit prices, such as has happened with oil – perhaps a world-wide “OPEC” for all the products exported by the countries in question ? – could make possible such a leap.[13]

This change could, naturally, be combined with an exceptionally powerful expansion of world economy which would dilute these disequilibria in the global growth of international trade and would thereby make ultimately positive the over-capacity of production implanted in consequence of external financing, as is pertinently noted in the OECD study already quoted.

We thus arrive, as it were, at the conclusion that there is a choice. Either repayment of the debt is materially out of the question, in which case the debtors need not bother, since nobody can be held to perform what is impossible: or an improbable scenario will enrich them sufficiently for the debtors actually to be able to pay their debts, and then they will have nothing to complain about.

Matters are somewhat different from the standpoint of the creditors. For them, not only is recovery of their loans impossible in itself but also, paradoxical as this may seem, it is hardly desirable. The 200 milliards of hypothetical “overs” in the trade balances of the debtor countries would correspond, in case of repayment, to an equivalent amount of “shorts” in those of the creditors.[14] This would find expression in several million more unemployed, which those countries really do not need.[15]

But the creditors cannot, either, resign themselves to a mere wiping-out of the sums due to them. Of course, if we consider the economic bulk of the creditor countries taken as a group, the loss seems bearable. Besides, in terms of real values – which are the only ones that concern the collectivity, financial values being merely claims by one agent upon another – this “loss” was already suffered when the corresponding amount of goods left their countries of origin. But a large part of these credits do not belong to the states of those countries but to a few big banks. However conventional they may be, these assets do constitute the “potential” of their operations. One can neither light-heartedly socialise their cancellation nor coldly allow allow the barks to fail.

The first solution would call in question the most fundamental principle of the competitive system, that of the individual risk assumed by the operators. The consequences for future deposits in these banks of such a precedent of “abandoning responsibility” would be formidable – not to speak of the micro-political fall-out of such use being made of “the taxpayers’ money.”

The second solution would threaten to start a chain-reaction of financial crashes with unforeseeable consequences for the world fiduciary system.

It is above all the concentration of these loans in a small number of large institutions that makes this situation explosive. (Taking a closer look, one is led to ask serious questions about the “responsibility” just mentioned, and, indeed, about the competence of the bankers.) Seven large American banks have lent to the countries with problems, especially to those in Latin America, sums which not only amount to several times their capital but are even a multiple of their own funds, that is, capital plus all reserves and undistributed profits put together.

Here are the figures:

| Manufacturers Hanover | 284 % |

| Chase Manhattan | 230 % |

| Citicorp | 218 % |

| Bankers’ Trust | 174 % |

| J.P. Morgan | 155 % |

| First Chicago | 149 % |

| Bark of America | 133 % |

(Fortune , January 1984)

This means that if, tomorrow, these banks were to be put into liquidation, by realising all their assets except their claims on the developing countries, not only would there be nothing left for their shareholders, but a part of the deposits could not be honoured. At the present time the shares of the premier bank in the world, the Bank of America, have a negative value.

Nevertheless, thanks to the tacit connivance of the financial community, covering up for faked accounts, this virtual insolvency does not affect their current liquidity. Despite the delays in payment of interest – sometimes veritable de facto moratoria – these banks continue to include in their accounts the “accrued” interest, thereby anticipating, as though nothing had happened, a future encashment which is worse than uncertain[16]. On the other hand, in contempt of all notions of duty, no provision is made for dubious credits – and this for a good reason. Making the slightest provision of that sort would have dissolved their current “profits” and put the accounts of their operations in the red.

Thus, Citicorp, for example, presents in its balance-sheet for 1982 a net profit of 747 millions. Among its assets figure 12 milliards in loans to the Latin-American countries alone. If it were to establish a provision of say, 20%, for dubious credits among these loans, which would be less than the devalorisation already suffered on the stock-exchange by those of them which are represented by negotiable bonds, its accountable “profit” of 747 millions would be transformed into a loss of millions. Even with a provision of only 10% there would be a loss of 453 instead of a profit of 747. The same reversal of results would take place with the Bank of America, which presents a net profit of 419.6 millions and is involved in Latin-American debts to the extent of 7 milliards.

What would happen if some “moment of truth” were to provoke a rush of depositors to the bank-tills? Faced with such a prospect, the banks plunge deeper and deeper into the impasse.

It is the inherent contradictoriness of their own position that constitute the weakness of the creditor countries, and also of the IMF, in their negotiations with the debtors. Collection being, in fact, as formidable a prospect as repudiation, these countries have nothing coherent to propose to or impose on the debtors, even if they possessed the necessary power.

Thus, Brazil is told to export as much as possible, at the same time as those who, say this feel obliged to close their frontiers against Brazilian goods. Brazil is also told to restrict her imports, while the spokesman of the United States government sharply rebukes the banks for having, by refusal of fresh credits to the developing countries, deprived them of the means of continuing to pay for these imports which give employment to the workers of the United States.[17]

But this is not all. For Brazil exports not only to the U.S.A. but also to Mexico which is just as much in debt as Brazil. So Brazil is told to export to Mexico in order to obtain funds to pay her debts, while Mexico is required to reduce her imports from Brazil for exactly the same reason.[18]

Ultimately, if they cannot ask their debtors either to pay or not to pay, all that is left for the creditors to ask of their debtors is to make believe – save the credibility of the IMF, so that the banks can continue with impunity to practise the cheating which consists in calling “new loans” what are really renewals of the old ones, and “collection of interest” what is merely its capitalisation. As the Financial Times correctly observed on 8 September 1983 the IMF says, in effect, to the debtor countries: agree to the bluff of austerity and we will shut our eyes to how you apply it.[19]

It has been thought that there could be an escape from the dilemma – deflationary trade balance or financial crash – by a third way, namely, converting part of the debts into shares in existing enterprises in the debtor countries. Semi-official approaches have apparently been made in this direction. These shares would be minority holdings – the figure 25% has been mentioned materialised through a holding company which would purchase, in the national currency, the appropriate amount of shares in the enterprises in question and hand over its own bonds to the foreign banks concerned.

It seems that the minor banks have rejected this idea out of hand, whereas the big ones have reacted to it rather favourably.

Without arguing from the attitude at the minor barks – as in every bankruptcy settlement, the small creditors tend to blackmail the big ones – we may doubt not only whether such a plan as this has any prospect of success, but also whether it is meant seriously.

We can, of course, imagine arrangements being made which would be akin to cheating already mentioned – in other words, arrangements which would improve not the real situation of the banks but only their balance-sheets. Also, it is true that it is not strictly exact to say, as I have said, that the settlement of a loan is effected either through reserves or through a negative balance of trade. In pure theory there is indeed a third way, namely, the transformation of credits into title-deeds. That would be, in a way, a retroactive reversal of the past practice (according to Benakouche) of the indebted governments, since they would be replacing, a posteriori, loan capital by risk- capital – with this (favourable) difference that what the financiers did not want to do when it was a matter of investing live money, they may well agree to do now that it is a matter of transforming dead credits. On the plane of reality, however, neither the effect nor the reliability of such a project is apparent.

It is quite clear that the proposed holding company could launch its take-over bid only at limited companies of a certain calibre, whose shares were dispersed among the public and quoted on the stock-exchange. Let us take the example of Brazil, with its debts of about a hundred milliards of dollars.

I do not possess the precise figure of the stock-exchange capitalisation of Brazil’s enterprises, but, to have some sort of a guide, let it be recalled that the stock-exchange capitalisation of the 750 French firms of all sizes which are quoted on the Paris stock-exchange amounts barely to 40 milliard dollars. If, then, it was a question of France, such a gigantic take-over bid, affecting 750 firms, would bring in, on the basis of 25% of the capital of each company, a packet of bonds worth 10 milliard dollars. Since, in fact, it is a question of Brazil, whose gross domestic product is about one-third the size of France’s, a fantastic operation like this, which would rend from top to bottom the economic and financial fabric of the country (supposing that everybody co-operated and the operation was successful) would bring in about 3 or 4 milliards, out of the 100-milliards debt.

But, quite apart from the sums involved and the inextricable technical problems inherent in such an operation, it is not clear what substantial difference it would make, other than the cosmetic improvement of balance-sheets mentioned above. Fixed-income bonds would be exchanged for bonds giving a variable return. The coupons of the one category would be replaced by the dividends of the other sort. Fine! But the problem of transfer across the frontier of the debtor country, as I have analysed it, would remain. The effect of a surplus of imports engendered by the repatriation of a dividend is no less deflationary than that which is engendered by the collection of a coupon. And the depreciation of a portfolio of shares as a result of non-payment of dividend is no less harmful to a bank’s reputation than the failure of its debtors to pay up.

In fact, the upper limit of the creditors demands is today mere renewal of the principal and capitalisation of the interest without any additional net transfer. But it is here that the weakness of their power to bargain is revealed. For the debtor countries not only do not agree to any net transfer that is detrimental to them, they refuse even to play the game on the basis of an operation in which neither side would lose. They are not interested in receiving a cheque and sending it back the next day, in order save the face of the IMF. They want something more – a net transfer in their favour. As we have seen this transfer is materialised by the positive difference between the increase in the outstanding debt and the total amount of interest due. In reality, and despite appearances, it is with this “something more” and nothing else that negotiation between the two sides is concerned. To date, the debtor countries have obtained what they wanted and on a large scale.

This explains the opposition recently voiced by several Latin-American governments to the idea of a concerted moratorium or of a cartel of the debtor countries (a sort of OPEC of debt). It has been seen as a sign of submission or “dependence”. The fact of the matter is, on the contrary, that they are the masters of the game. Why, indeed, should they need a moratorium or a cartel conceived, by definition, as a a way of excusing them from suffering a hypothetical negative transfer, when, without a moratorium or cartel, they can do better than that, obtaining an actual positive transfer?

24 March 1984

Credits: Salmin for processing the text.

- Cf. “External Indebtedness of Developing Countries”, occasional Paper No. 3 IMF, May 1981. ↑

- Here we see how slippery are the deflaters used by the IMF in order to bring the two rates together. Whatever the degree of erosion of the currency, it is more or less compensated by the increase of the multiplier (rate of interest), while the multiplicand itself (the outstanding debt) also increases in parallel. ↑

- Cf. e.g., Claudio Jedlicki: “From the impossibility of repaying debts to the indispensable repayment of banks,” paper presented to the colloquium of the GREITD, 24-25 February 1984 (GREITD = Groupe de Recherche sur l’Etat, internationalisation des Techniques, Développement) ↑

- I must admit that I myself thought that this “corollary” was inevitable only in a market economy until I read this unanswerable remark by J.K.Nyerere: “Strict application of the principle of equality would require that all children should be given the possibility of attending primary school before we spent any money on secondary or higher education. But, in that event, how would we be able to develop our country?” (Quoted by Jean-Pierre Tournon, in “Adaptation of techniques and progressive industrialisation of the Third World”, duplicated paper). ↑

- “Origins and crisis of Brazil’s indebtedness”, paper presented to the GREITD colloquium,, 24-25 February 1984. ↑

- All the same, it would be piquant if, after nailing to the pillory the multi-nationals and those Third World governments which have welcomed them, one were now to start blaming these same governments for having wished to replace them by loan-capital. ↑

- Byé, in International Economic Relations, mentions that in the century three-sevenths of Britain’s national debt was held in Holland. Moreover, as the Economist of 18 February 1984 recalled, the ratio between national debt and gross domestic product in the United States in the second half of the century was higher than that of Brazil or Mexico today. ↑

- This would have been utterly absurd, moreover, if the developing countries had borrowed funds at the high market rate in order to keep them as reserves, bringing in, as such, a lower rate of interest or even none at all. Nevertheless, there are signs, here and there, which give cause to think that certain countries may, at some moments, have utilised an increase in their reserves as a lever to improve their brand-image and thereby, later, to obtain fresh credits amounting to many times the amount thus sterilised in their reserves. ↑

- In the case of Mexico, this proportion is as high as 90%.

Percentage of imports constituted by Year Consumer goods Intermediate and capital goods 1977 8.8 91.2 1978 8.2 91.8 1979 8.3 91.7 1980 13.0 87.0 1981 11.7 88.3 1982 10.5 89.5 (Banco de Mexico, quoted by R.Paniagua-Ruiz at the GREITD colloquium already mentioned) ↑

- The most remarkable point that emerges from these figures is that this external financing, far from having stimulated an expansion of ultimate consumption, was, on the contrary, concomitant with a relative contraction of it, since investment advanced by four points, whereas external saving contributed only two. ↑

- The figures of the World Bark emphasise this difference, giving between 5.1 and 5.2% to the oil-importing, developing countries, as against 2.5 % to the industrialised countries. ↑

- I regard as rational, for this reason, the practice of international organisations in grouping under the same heading all unilateral transfers, whether these be free of charge or subject to repayment, even though, of course, I do dot agree with term “Aid” which figures as this heading. ↑

- I have always maintained that the only really significant unilateral transfer of wealth from one country to another is implicit transfer through unit prices, whereas the explicit transfer by way of quantities is marginal, at any rate in the present epoch. We see here that, even for an explicit transfer, it is always prices, and prices alone, that can serve as vector, as soon as this transfer goes beyond the intrinsic elasticity of the balances. ↑

- Or perhaps a little less, if some of these “overs” were gained on exchanges between non-OPEC countries with OPEC countries. That would still seem improbable in so far as their additional exports to the OECD countries destined to cover their repayment, would necessitate, on the other hand, a larger amount of fuel imports. ↑

- More than 3.5 million, according to an estimate by C.Jedlicki, op.cit. ↑

- According to the Wall Street Journal of 9 March 1984, if the banking regulations were respected, some banks ought to cancel by counter-entry up to nine months of interest payments which are included in their results but have not actually been cashed. It is estimated, for example, that the arrears of interest of Argentina alone amount to 2.5 milliard dollars. ↑

- Cf. the statements of George Shultz on 14 February 1983 to the Foreign Relations Committee of the U.S.Senate. ↑

- Thus, as Fortune noted on 28 November 1983: “When Mexico and Argentina curbed imports last year, Brazil’s exports fell and its ability to pay its bankers went from doubtful to impossible.” ↑

- This does not, of course, rule out cases where a particular government may make use of the “pressure” from the IMF to justify domestically a policy of austerity which it wishes, itself and for its own benefit, to impose on its workers. ↑