Here we link Arghiri Emmanuel’s work “Unequal Exchange Revisited” published in 1975. You fill find the original PDF on the link below, and the digitalised text in this article. We apologise for the quality of tables and mathematical formulas, but we are limited by the capabilities of the software platform we use for publishing. We will strive to work on improvements but in the meanwhile, you can consult the original PDF for more clarification. Feel free to contact us with suggestions and corrections.

Thanks to Rob Ashlar et al for contributing a printable PDF version of this article that can be downloaded here.

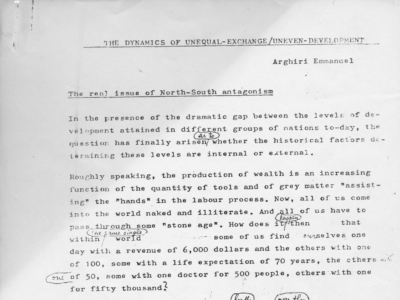

DISCUSSION PAPER “UNEQUAL EXCHANGE REVISITED” by Arghiri Emmanuel.

IDS Discussion Paper No. 77 August 1975

This preliminary paper develops some themes in the author’s earlier work, published in Unequal Exchange (New Left Books, London 1972).

The paper can be divided into four main sections. The first deals with the international division of labour and foreign trade, developing the critique of Ricardo’s theory of comparative advantage using both algebraic and numerical examples. The critique of the theory of comparative advantage is extended to deal more fully with the Heckscher-Ohlin theory of factor proportions. The second section deals with the formation of international values.

After spelling out what is called ‘the unmanageable reality’ for the factor proportions theory, it shows how the assumptions of the factor proportions theory should in fact be reversed.

The Theorem of Unequal Exchange is then stated and proven in terms of the Sraffa system modified to encompass international exchange. The section ends with an analysis of the tendency towards the international equalization of the rate of profit. The third section examines in some detail the economic and political factors which determine wages, and the final section deals with the question of unequal exchange and uneven development. Here, the relationship between consumption and accumulation, and the revolutionary consequences of the analysis are set out.

INTERNATIONAL DIVISION OF LABOUR AND FOREIGN TRADE

Private Exchange and the social framework

All economic relations between men or groups of men – communities, nations, etc., – are directly or indirectly connected with a certain division of labour. inside of each community this takes the form of a “social division of labour”; outside it takes the form of an “international division of labour”.

In turn, every division of labour, be it “social” or “international” implies some given rules of distribution of the product, in such a way that the one is the necessary condition of the other.

But neither the social division of labour nor the international division necessarily implies a private exchange of the product. This is important for it is on this point that the basic mistake of Adam Smith lies.

On the one hand, he noticed that no human society could exist without some division of labour, human needs being too great to be satisfied by an individual effort. He considered, on the other hand, that in the societies known to him the distribution of the products was indeed carried on through exchanges between independent producers. He therefore came to the conclusion that the propensity to exchange privately is as much an integral part of human nature as is the division of labour.

Now, we should of course admit that individual man – a social animal – having to appropriate nature in order to reproduce himself, is unable to do so without some sort of collaboration with other men. This entails the dividing up of the many tasks that this appropriation involves. It is, further, to be admitted that such cooperation in production implies a distribution of the whole product among the participants. But it does not follow at all from these premises that the only way of distribution is the private one.

In the primitive (tribal) community, a social division of labour does exist, but there is no private exchange, except occasionally, and to such a marginal degree that the essential process of the reproduction of social life is in no way interfered with. The same holds for the future socialist society when the market will have disappeared.

In these two types of integrated society, the social division of labour and the subsequent distribution of the product forma single inseparable process, set up ex ante by a single direct act of the decision-making centre, be it the chief and elders in tribal collectivism, or the plan in the advanced socialist society.

On the contrary, in the type of society where the distribution of the product is carried out by means of a system of privately agreed-upon exchanges (mercantile relations), it is those exchanges and their ex post outcome that determine indirectly the social division of labour through a series of micro-economic decisions taken at the level of independent producers.

Consequently, the second part of Adam Smith ‘s statement is unsupported. Social division of labour is indeed a permanent constituent of the social nature of man; private exchange and commerce are just one of its historic elements.

Private exchange and the international framework

Things are somehow different when considered in the international context. The Central planning of either division of labour or distribution of the product has never existed.

Even in the epoch of tribal collectivism, when the primitive communities exchanged their products between them, they always did it on a transactional basis and it is this fact that led some economists to contend that foreign trade historically preceded domestic trade. As regards the present, even the so-called States of transition towards socialism, more or less planned, regardless of the extent to which they have abolished their domestic trade, still present themselves internationally as independent bargaining dealers. ((We do not take into account here certain attempts of ex ante planning of exchanges and of the international division of labour within certain groups of countries, as, for instance, the COMECON. By any standard, these attempts do not seem to have gone very far.))

However, the fact that, up to the present time, the market has always conditioned the international division of labour and its extension is not sufficient in itself for reaching the conclusion that things could not be otherwise. One can perfectly well conceive of a socialist world plan implementing centrally the division of labour and the distribution of the produce on a planetary scale.

The determination of the International division of labour

When we say that the International division of labour has always, up to now, taken place on a private trade basis, we must add an important qualification. Although not centrally co-ordinated (planned) the international division of labour was nonetheless to a certain extent socio-historic (institutionally and politically) instead of being geo–economic. Instead of being the outcome of objective laws, that is, the effect of the variety of the natural resources of each country, the international division of labour has often been determined, if not globally, at least piecemeal, for the dominated countries by the deliberate action of the dominant countries.

Products which today seem indigenous such as cocoa, palm oil, and groundnuts in Western Africa, grapes in Algeria, cotton in Egypt, maize, maioc, many varieties of bananas in Black Africa have often been the object of either entirely artificial transplantation or a deliberate expansion of preexisting cultivation, far exceeding the proportions which would be suggested by the geo-climatic environment. The famous comment by Marx in his Discourse on Free-Trade seems in this connection quite plausible.

“You probably think, gentlemen, that coffee and sugar production was the natural destiny of the West Indie. Two centuries ago, nature which does not care about trade, had put there neither coffee nor sugar-cane.”

Despite the existence of an international market and of a foreign trade based on transactional exchanges, which created a certain international division of labour, the evolution of that division was marked by innumerable discontinuities set up by the interference of the most advanced states when dealing with the rest of the world.

This interference either took place with the political domination of certain areas in the “rest of the world” or without this domination. We can include under the first heading all official measures implemented in the context of conquest and colonization, ranging from the open violence of direct plunder to the enactment in dependent territories of customs tariffs favourable to the home country. In between lay all other legislative restrictions on the products of the dominated country as well as regulations regarding maritime transport, such as the so-called “Navigation Act”, and so on. In the second category – deliberate interference with free trade without the political domination of the partner – we include all protectionist measures, direct or indirect, taken within the advanced countries themselves. Direct measures include prohibitions or quotas on certain imports or exports, legislative restrictions on the free circulation of monetized metals etc. indirect measures include customs duties of any kind on imports or on exports.

Mercantilism

The official steps mentioned above, were, during the whole period, from about the beginning of the 16th to the end of the 18th century, influenced by the economic infrastructure of the dominating country. An ideological superstructure called “mercantilism” corresponded to this infrastructure.

Mercantilism is less a system of Political Economy and more a doctrine of economic policy. Mercantilist authors, particularly those of the 16th, 17th and the early 18th century, are not theoreticians and it is admitted that Economics did not yet exist as a science. These authors appear as experts who endeavoured to create for their respective governments useful trade policies for the beneficial management of the affairs of the State, particularly in the field of its economic relations with foreign countries. They did not worry about rationalizing the world economy, the very concept of which was beyond their scope. Assuming that the only possible profit in international economic relations is the “alienation profit”, they unhypocritically sought, each one for the benefit of his own country, ways and means of getting richer to the detriment of the others. “The city in its trade must care about itself, never about other peoples”, Aristotle had already said.

Mercantilists could not even imagine that it was at all possible for one to get richer without a proportionate impoverishment of one’s partner. According to Colbert, trade is like war. The victory of the one party meant ipso facto the defeat of the other.

Obsessed by the fear of unemployment which (notwithstanding widespread opinion to the contrary) was in their time more severe than in any other later period under advanced capitalism, the mercantilists were mainly interested in seeking outlets abroad for the national product. For this purpose, they recommended two sorts of measures, the first one quantitative, the second, qualitative.

-

1.A policy of simultaneous autarky and trade expansion.

The apparent contradiction between these two targets was resolved by a one-way trade, that is, by a permanent surplus on the balance of trade.

-

2.A policy of close selection of exports and imports so that the exports embody the most possible, and the imports the least possible amount of living labour. This meant that they attempted to export manufactured goods and import raw materials.

John Law, who was not a mercantilist in the proper sense, was nonetheless clearly asserting towards the end of the 17th century that the greatest blessing in foreign trade was for a country to be supplied with raw materials from other countries and to find a market for its own manufactured products in those same countries. In this context, he complained about French wool being sent out to Holland and coming back afterwards under the form of manufactured articles.

The orthodox mercantilists of the 16th and 17th centuries were more outspoken. Thus Forbonnais could write:

“It is a law, springing out of the very nature of the colonies, that they ought to have no crops or industry which could compete with crops and industry of the home country”.

He blamed the Europeans, particularly the British, for having let sugar-refineries be established in the colonies which produced sugar. ((Elements du Commerce, Ed 1754,Vol 1,p 372 et p 393. The economic policy of the mercantilists, indifferently called the mercantilist system or nationalist system, has survived its promoters and constitutes a constant element of the everyday practice of developed capitalist countries. As late as 1907, Andrew Bonnar Law, afterwards Prime Minister of Britain, contended that the preferential regime for the Empire meant merely that a greater part of our imports must be composed of raw materials destined to be processed in the country, and that a greater and greater proportion of our exports must be composed of manufactured products providing jobs for our workers. (quoted by Bennett, The Concept of Empire, Edinburgh, 1952).

As regards the quest for specialization in, (and consequently the quest for outlets abroad for), those products embodying more manpower, a qualification must be added. The point obviously is more manpower in relation to the consumed constant Capital, that is, in relation to the other material inputs entering into the production of a unit of the output, not in relation to the fixed Capital or to the total Capital invested.

Consequently, the matter is not one of “labour intensive” branches (“low organic composition of Capital”), which on the contrary are considered as disadvantageous.

The above criterion has actually played an important role in the evolution of the economic policy of the presently developed countries.))

Classical economics and Free-Trade Absolute costs – Comparative costs

A first reaction against mercantilism came from Quesnay and the French Pysiocrats towards the middle of the 18th century. But regarding foreign trade, it is Adam Smith and Ricardo in England who mark the decisive turning-point in economic thought.

For the first time a class – the industrialists – came into power that was interested in a two-way trade, in real exchanges, which would widen the international division of labour.

This class did not wish merely to import raw materials and export manufactured goods, something which everybody agreed upon. It also needed cheap provisions for its workers and this was something which ran totally counter to the interests of landowners whose rents weighed considerably on corn prices. It is on this point that Ricardo diverges from Adam Smith.

The latter had already realised the futility of seeking surplus for surplus’ sake, if only for the simple reason that if all countries did the same thing, international trade would be blocked and there would be no surplus anywhere. It is the equilibrated balance of trade with a greater turnover in both directions which was the goal to reach.

However, by linking international exchange to absolute cost, Adam Smith prevented the solution to the problem. For, in absolute terms, Britain was more productive than the rest of the world not only in manufactures, but also, to a lesser, but still considerable degree, in agricultural production. ((Here we have one of those forgotten facts of economic reality. Britain was a great exporter of corn, up to and including the 18th century. At that time she was considered as one of the granaries of Europe. It is only during the 18th century that little by little this status declined and it is only during the 19th century that the situation was reversed.))

Now, if landowners rents were reduced, British corn prices would become lower than those of foreign countries. Under these conditions it was not clear what Britain would import from abroad (except some raw materials like cotton or sugar, or some particular commodity like tea) in order to counter-balance her massive exports of manufactured goods. That is, it was not clear if substantial imports of corn were to provide a counter-part, or if corn outflows – however irregular were to be added to the export side.

It is the solution of this problem that Ricardo attempted with his comparative costs theorem. The solution consists in suggesting that, notwithstanding the superiority of Britain in corn production, free exchange would not induce exports of corn but imports because her superiority in manufactures was even greater than the one she enjoyed in production from the land.

Torrens formulated this idea in his “Essay on the external corn trade”, 1815, in the following words:

“If England should have acquired such a degree of skill in manufactures, that, with any given portion of her Capital, she could prepare a quantity of cloth, for which the Polish cultivator would give a greater quantity of corn than she could, with the same portion of Capital, raise from her own soil, then tracts of her territory though they should be equal, nay, even though they should be superior to the lands in Poland, will be neglected; and a part of her supply of corn will be imported from that country. For, though the Capital employed in cultivating at home might bring an excess of profit over the Capital employed in cultivating abroad, yet, under the supposition. the Capital which should be employed in manufacturing would obtain a still greater excess of profit; and this greater excess of profit would determine the direction of our industry.”

At about the same time. Ricardo completed his theorem with the famous example of Portuguese wine and British cloth: Portugal is able to produce one unit of wine with 80 units of labour (hours, days, etc.,) and one unit of cloth with 90, while Britain needs 120 units of labour to produce the former and 100 to produce the latter.

|

Countries |

Wine |

Cloth |

|

Portugal |

80 |

90 |

|

England |

120 |

100 |

Although, according to absolute cost; both products cost less in Portugal, this country will nevertheless specialize in wine and leave cloth to Britain. The respective specializations are determined by the fact that the wine/ cloth cost ratio is more favourable in Portugal than in Britain and the cloth/wine ratio more favourable in Britain than in Portugal, that is, by the fact that:

|

8/9 < 12/10 |

or that |

10/12 < 9/8 |

In this example, it is Portugal which is the most productive country in both branches under consideration. But this ordering is merely an assumption, outside the real scope of the theorem. What matters is that, despite the general absolute disadvantage of one of the countries, this country (Britain, under the circumstances) will be able to specialize in one of the products, namely in the one in which she has a relative advantage reflecting the fact that her absolute disadvantage in it is less important.

Formulated in this way, the theorem looks like an unfruitful intellectual exercise. But what Ricardo was interested in was to show that under whatever circumstances, the opening and liberalization of international trade was profitable to all participating countries.

This optimization could be expressed in two ways: maximization of the output for the same productive effort (cost), or minimization of this effort for the same output. It is this second form which was adopted by Ricardo in his example.

Before trading began, the whole system (Britain-Portugal) had to spend a total of 390 units of labour in order to produce two units of wine and two units of cloth. With the opening up of trade and the subsequent specialization of each of the countries in one of the two products, 360 units of labour would be sufficient for the same result

Such a theory could provide a century-late vindication of the Methuen treaty of 1703 establishing freedom of trade between the two countries for the greatest “mutual benefit” (according to the wording of the treaty)and assigning to Portugal the agricultural vocation. The theory has constituted ever since then the cornerstone of the free- trade argument. It was such a glaring and at the same time unexpected truth, that it seemed consistent with the common interests of mankind to send out the British gunboats in order to bring the good message to the most distant Barbarians, who persisted in opposing the free penetration of liberating and welfare-generating trade. ((At the same time, this theorem was given the force of dogma by academic economics. It became a commonplace reproduced in all textbooks on foreign trade. A humorous version presented by Kindleberger enjoyed a wide audience: Billy-Rose a well known personality of New York, was a theatrical impressario, but it so happened that he was, at the same time, a world Champion typist. In spite of this, he found it advantageous to hire a secretary, because notwithstanding his absolute advantage over his secretary in the field of typewriting, this advantage became negligible when compared with the one he enjoyed over her in the other activities of his profession. It was therefore advantageous that both specialize.))

Some critical comments on “comparative costs”

Physical and monetary costs

The first fact to be acknowledged on reading the comparative costs theorem is that its author argues as if each of the trading countries – Portugal and Britain – was a single economic subject possessing the decision-making power (for example, as if Britain was Billy-Rose and Portugal his secretary) to produce and exchange wine and cloth.

If this were the case it would be obvious that each of these two countries would be interested only in the physical costs involved in each line, in other words, in the social costs. So, if the wine-cloth social cost ratio is 8/9 in Portugal, it is obvious that Portugal will readily give up cloth production and devote herself to the production of wine, as soon as she is offered on the foreign market more than 8/9 of a unit of cloth for one unit of wine. Likewise, Britain, where wine costs 12/10 cloth will give up production of wine, as soon as she can get it through exchange by giving less than 12/10 of her cloth. The choice of the “right” specialization within both countries is, under the circumstances, beyond doubt.

But in the real world, the one of capitalist relations, and more particularly the one of free-enterprise, which, furthermore, is the one advocated by the promoters of the theorem, there are not merely two countries, but a crowd of Portuguese business-men on the one hand and a crowd of British business-men on the other. These independent producers are acting individually and with a view to maximizing their profit, which means that what they are interested in minimizing is not the social (physical) cost of wine and cloth but their private monetary cost.

In order that the actions of business men lead to the optimal specialization, it is therefore necessary that the ratio of monetary costs be equal to the ratio of physical costs. In other words, it is necessary that the quantity ratio of the factors, needed for producing wine and cloth, be equal to the price ratio of these factors. For this price is the only element which is of interest to the independent producers.

This equality holds if there is but one factor of production. It does not if there are several.

A single factor

Let us assume that the only factor of production in our system, and the before the only constituent of the social cost, is labour, which is homogenous, that is, simple labour of an identical quality everywhere.

Let:

Pwl be the quantity of labour for producing one unit of wine in Portugal.

Pcl be the quantity of labour for producing one cloth in Portugal.

Ewl be the quantity of labour for producing one unit of wine in Britain.

Ecl be the quantity of labour for producing one cloth in Britain.

Ricardo’s theorem says that if

|

Pl Pcl < Ewl Ecl

|

Portugal will specialize in wine and England in cloth and that these are the optimal specializations.

We contend that independent producers do not take into account quantities of labour spent on the production of wine and cloth but what they pay for these quantities. We should therefore examine whether or not the two ways of assessing coşt lead to the same results.

If the remuneration of one unit of labour is x in Portugal and y in England, the cost ratios which will be relevant for the independent producers will no longer be Pwl/Pcl in Portugal and Ewl/Ecl in England, but x (Pwl) / x (Pcl) for the former and y (Ewl) / y (Ecl) for the latter.

Nevertheless, there can be no bias therefrom for respective decisions. For it is obvious that

|

( x × ( Pwl ) ) ( x × ( Pcl ) ) = Pwl Pcl

|

and |

( y × ( Ewl ) ) ( y × ( Ecl ) ) = Ewl Ecl

|

for any value of x and y.

In other words if

|

Pwl Pcl < Ewl Ecl

|

then

|

( x × ( Pwl ) ) ( x × ( Pcl ) ) < ( y × ( Ewl ) ) ( y × ( Ecl ) )

|

whatever x and y may be.

Consequently, in the case of a single factor, the capitalist’s cost calculation made on the basis of the remuneration of this factor, leads to the same results (therefore it is optimal) as the cost calculation which would be made by an integrated (planned) society on the basis of the quantities of this same factor.

To go back to Ricardo’s example, we say that Portugal will specialize in wine and England in cloth because 80/90 120/100.

If wages were 10 escudos for one unit of labour in Portugal and 20 shillings in England, the above inequality would become 800/900 2400/2000 and nothing would be changed. One can vary the rate of wages in the one and/or other country (and also, if one likes, the rate of exchange): it will always be more profitable for Portugal (or its entrepreneurs) to get cloth through exchange rather than to produce it locally. Likewise, it will always be more profitable for England to get her wine through exchange rather than produce it herself, and this holds, irrespective of whether the specialization is decided in a macro-economic way by the society or in a micro-economic way by the individual firm.

Several factors

-

a)In equal proportions

The situation would be the same if we had several factors of production, with each entering in the same proportion into both wine and cloth in each country (ie. equal organic compositions).

Suppose there were any two factors (labour and Capital,’ or simple and qualified labour, or labour and land etc.,) symbolized by 1 and r, so that Pwr, Pcr, Ewr, Ecr are the quantities of the second factor needed to produce respectively one unit of wine in Portugal, one unit of cloth in Portugal, one unit of wine in England, and one unit of cloth in England.

If:

x = remuneration of one l in Portugal

y = ” ” ” r in Portugal

z = ” ” ” l in England

w = ” ” ” r in England

if, further:

|

Pwl Pwr = Pcl Pcr

|

and |

Ewl Ewr = Ecl Ecr

|

(i.e., if the organic compositions of both branches in each country are equal)

and, if, lastly,:

|

( ( x × ( Pwl ) ) + ( y × ( Pwr ) ) ) ( ( x × ( Pcl ) ) + ( y × ( Pcr ) ) ) < ( ( z × ( Ewl ) ) + ( w × ( Ewr ) ) ) ( ( z × ( Ecl ) ) + ( w × ( Ecr ) ) )

|

then

|

( ( x ‘ × ( Pwl ) ) + ( y ‘ × ( Pwr ) ) ) ( ( x ‘ × ( Pcl ) ) + ( y ‘ × ( Pcr ) ) ) < ( ( z ‘ × ( Ewl ) ) + ( w ‘ × ( Ewr ) ) ) ( ( z ‘ × ( Ecl ) ) + ( w ‘ × ( Ecr ) ) )

|

for any value of x’, y’, z’, w’. That is to say, the choice of specialization is independent of the variations in the rates of remuneration.

Example

Let us suppose that there are two factors, labour and Capital (l,k), entering into the production of these two commodities in the proportion of 1:1 in Portugal and 3:1 in England. In this case, the costs assumed by Ricardo, 80, 90, 120, 100, respectively could be split up as follows:

|

( 40 l + 40 k ) ( 45 l + 45 k )

|

( 90 l + 30 k ) ( 75 l + 25 k )

|

If entrepreneurs pay the unit of l (labour) 2 escudos in Portugal and 3 shillings in England and the unit of K, one escudo in Portugal and 1 shilling in England, we will have the following cost ratio in Portugal:

|

( ( 2 × 40 ) + ( 1 × 40 ) ) ( ( 2 × 45 ) + ( 1 × 45 ) ) = 120 135 = 8 9

|

and the following ratio for England:

|

( ( 2 × 90 ) + ( 1 × 30 ) ) ( ( 2 × 75 ) + ( 1 × 25 ) ) = 210 175 = 12 10

|

and nothing will have changed as far as the ratios are concerned.

One can vary at will the respective rates of remuneration of l and k, in the one and/or the other country – wine will always be the most advantageous specialization for Portugal and cloth for England, whatever the multiplicand of factor quantities in each country. Consequently the micro-economic reckoning leads us to the same results as the macro-economic reckoning and Ricardo’s theorem remains valid.

-

b)In unequal proportions

However, up to now, the assumptions upon which our analysis was based have been unrealistic.

In the real world, not only is there more than one factor entering into the various products but their respective proportions are unequal from branch to branch. In certain branches the proportion of Capital as compared to labour (the organic composition of capital or the capital-intensity) is greater than in others. The same can be said for the proportion of skilled to unskilled labour, or for the proportion of land as compared to other factors, etc.

In that case:

|

Pwl Pwr ≠ Pcl Pcr

|

and |

Ewl Ewr ≠ Ecl Ecr

|

and, consequently the inequality,

|

( x ‘ ( Pwl ) + y ‘ ( Pwr ) ) ( x ‘ ( Pcl ) + y ‘ ( Pcr ) ) < ( z ‘ ( Ewl ) + w ‘ ( Ewr ) ) ( z ‘ ( Ecl ) + w ‘ ( Ecr ) )

|

does not necessarily hold for any value of x’, y’, z’, w’, and it may be reversed. This means that the micro-economic decision-making of the enterprise based on the remunerations of the factors may lead to the “wrong”, (suboptimal) specialization.

Example

Let us assume that to produce wine and cloth in these two countries we only need two factors, engineers and labourers. Let us further assume that their proportion in the production of wine is one hour of engineer ‘s work for every 70 hours of labourer’s work and in the production of cloth, one hour of engineer’s work for 5 hours of labourer’s work. Let us lastly assume that in both countries one engineer’s hour is equivalent to 10 labourer’s hours. Comparative costs in Ricardo’s example will be split up as follows:

|

Countries |

Wine |

Cloth |

Totals |

|||||

|

|

Concrete lab. |

Coefficient |

abstract lab. |

Concrete lab. |

Coefficient |

abstract lab. |

Engin. |

Labourers |

|

Portugal |

||||||||

|

Engineer |

1 |

10 |

10 |

6 |

10 |

60 |

7 |

|

|

Labourer |

70 |

1 |

70 |

30 |

1 |

30 |

|

100 |

|

|

80 |

|

90 |

|

||||

|

England |

||||||||

|

Engineer |

1 1 2

|

10 |

15 |

6 2 3

|

10 |

66 2 3

|

8 1 6

|

|

|

Labourer |

105 |

1 |

105 |

33 1 3

|

1 |

33 1 3

|

|

138 1 3

|

|

|

120 |

|

100 |

15 1 6

|

238 1 3

|

|||

Portugal will therefore specialize in wine and England in cloth.

After trade (in hours of living labour)

|

|

Wine |

Cloth |

Totals |

|||||

|

Countries |

concrete labour |

coefficient |

abstract lab. |

concrete lab. |

coefficient |

abstract lab. |

Engineers |

Labourers |

|

PORTUGAL |

||||||||

|

Engineer |

2 |

10 |

20 |

– |

– |

– |

2 |

|

|

Labourer |

140 |

1 |

140 |

– |

– |

– |

|

140 |

|

ENGLAND |

||||||||

|

Engineer |

– |

– |

– |

13 1 3

|

10 |

133 1 3

|

13 1 3

|

|

|

Labourer |

– |

– |

– |

66 2/3 |

1 |

66 2/3 |

|

66 2/3 |

|

|

|

|

160 |

|

|

200 |

15 1/3 |

206 2/3 |

Balance of the whole (in hours of living labour)

|

|

Engineers |

Labourers |

Ab s t r a c t |

|

Before trade |

15 1/6 |

238 1/3 |

390 |

|

After trade |

15 1/3 |

206 2/3 |

360 |

|

Differences |

+ 1/6 |

-31 2/3 |

-30 |

With trade and specialization, the whole system, Portugal and England, spends, for the same final result, an extra 1/6 of an engineer’s hour and saves 31 2/3 labourer ‘s hours. Since in neither country is the engineer’s hour worth more than 10 labourer’s hours, the total system draws an absolute advantage from the opening of the trade. This advantage is equivalent to 30 hours of abstract labour.

Let us now assume that, following a socio-cultural change in Portugal, the engineer’s hour is no longer worth 10 but only 5 labourer’s hours, the English wage-rates and all other conditions remaining unchanged. Comparative costs would work out as follows:

Before trade ( in hours of living labour)

|

|

Wine |

Cloth |

Totals |

|||||

|

Countries |

concrete labour |

coefficient |

abstract lab. |

concrete lab. |

coefficient |

abstract lab |

Engineers |

Labourers |

|

PORTUGAL Engineer |

1 |

5 |

5 |

6 |

5 |

30 |

7 |

|

|

Labourer |

70 |

1 |

70 |

30 |

1 |

30 |

|

100 |

|

|

|

|

75 |

|

|

60 |

|

|

|

ENGLAND |

|

|

|

|

|

|

|

|

|

Engineer |

1 1 1 2

|

10 |

15 |

6 2/3 |

10 |

66 2/3 |

8 1/6 |

|

|

Labourer |

105 |

1 |

105 |

33 1/3 |

1 |

33 1/3 |

|

138 1/3 |

|

|

|

120 i |

|

|

100 |

15 1/6 |

238 1/3 |

|

But then the effect for the whole system is detrimental, as is shown in the following tables:

After trade (in hours of living labour)

|

|

|

Wine |

|

Cloth |

Totals |

|||

|

Countries |

concrete labour labour |

coefficient |

abstract labour |

concrete labour |

coefficient |

abstract labour |

Engineers |

Labourers |

|

PORTUGAL |

|

|

|

|

|

|

|

|

|

Engineer |

– |

– |

– |

12 |

5 |

60 |

12 |

|

|

Labourer |

– |

– |

– |

60 |

1 |

60 |

|

60 |

|

ENGLAND |

|

|

|

|

|

|

|

|

|

Engineer |

3 |

10 |

30 |

|

– |

– |

3 |

|

|

Labourer |

210 |

1 |

210 |

– |

– |

– |

|

210 |

|

|

1 |

|

240 |

|

|

120 |

15 |

270 |

|

|

Engineer |

Labourer – |

|

Before trade |

15 1/6 |

238 1/3 |

|

After trade |

15 |

270 |

|

Differences |

– 1/6 |

+ 31 2/3 |

The balance-sheet of the International division of labour carried out on the basis of comparative cost is therefore negative, since, for 1/6 of an engineer’s hour saved, the whole System, Portugal-England, spends 31 2/3 extra labourer’s hours, in order to obtain the same output as in the before-trade situation, that is, two units of cloth and two units of wine. Given that in neither country is the engineer‘s hour worth more than 10 labourer’s hours, the overall result is disadvantageous.

We conclude that Ricardo’s theory of comparative cost can only provide the optimal specialization if we accept the hypothesis that the monetary cost, made up of the market prices of the factors, reflects accurately the social cost, or in other words, that the price of each factor is proportionate to its actual contribution to the social product. Here again, we come across the basic postulate of the liberal economists: what is good for society is good for the private firm and vice versa. If we reject this postulate, the theorem of comparative costs collapses.

It is this postulate that the Heckscher-Ohlin theory of the proportions of factors has added to the Ricardian theory of “comparative costs”, in order to be able to cope with objections of the sort we have raised above.

The theory of specialization according to factor endowments

Bertil Ohlin begins, as we ourselves have done above, by refuting the hypothesis of the equality of factor proportions entering into each product. Different products require different factor proportions. But, at the same time, each country is endowed with given quantities of each factor. The latter are assumed to be not only immobile from country to country, but entirely fixed within each country.

Under these circumstances, each country specializes in the branches which provide the largest employment for her most abundant factor and avoids the branches which require relatively large proportions of her most scarce factor.

By so doing, she increases the demand for her most abundant factor and reduces the demand for her most scarce factor. It follows that as she advances on the specialization path, her most abundant factor becomes less and less abundant and her most scarce one becomes less and less scarce. The equilibrium is reached at the point of full-employment of all her factors. This point of equilibrium corresponds to the optimal specialization for the whole world and for each country taken separately.

How can it be that a country is able to choose her specializations according to her most abundant factors, since it is not the country but her independent producers who decide

Heckscher-Ohlin do not tackle this question. For them, as for all the neo-classicals, it is an established fact that the price of a factor, like the price of any other commodity, is proportionate to its relative scarcity. It follows that the most abundant factor is automatically the cheapest one just as the scarcest factor is the most expensive one. So, it is by endeavouring to minimize their own cost of production that the entrepreneurs will choose the specializations which are optimal for the society as a whole.

To the argument regarding suboptimal specialization, Heckscher-Ohlin would answer that if the price of engineers drops in Portugal from 10 to 5 times the labourer’s wage, or if the price of land doubles in this country, as we have assumed in our example, this means that engineers have become abundant in Portugal, scarce in England or that land has become scarce in Portugal and abundant in England.

Under these circumstances, there is nothing abnormal or suboptimal in Portugal specializing in cloth and England specializing in wine. Portugal, being unable to export her excess of engineers, exports goods embodying much engineer work and England, being unable to export her land, exports goods rich in “land”. Mobility of goods serves as a substitute for mobility of factors. Instead of importing Capital one imports capital-intensive goods and instead of importing technicians one imports goods embodying much technical work, and so on.

In this manner, a close link is set up between international trade and the distribution of revenue. Trade will tend to equalize not only prices of goods, but also prices of factors. This is because, on these premises, if trade is free, countries where land and unskilled manpower are abundant and cheap, while Capital and technicians are scarce and expensive, would specialize in agricultural production and give up manufactures. Consequently, the demand for land and unskilled labour will be increased and the prices of these factors will increase, while the price of Capital and of skilled labour will decrease.

The opposite effect will take place in the countries which are well supplied with Capital and technicians but “poor” in land and unskilled labour. These two movements will finally bring about an equalization of the price of each factor, labourer’s wage, ground-rent, salary of technicians, rate of profit, etc., within all trading countries.

Criticism of the theory of factors proportions

The theorem of Heckscher-Ohlin is grounded essentially upon two very strong assumptions: distribution of income proportionate to the relative scarcities of factors, and immobility-immutability of all factors. Both are unacceptable.

The first assumption rules out any idea of the distribution of national income being influenced by the struggle of antagonistic classes and groups, or, more generally, by the relationship of power between them. This is inconsistent with all historical experience. The rate of profit is surely not a scarcity price, if by that notion we mean that in each country it increases or decreases as available Capital per head of inhabitant decreases or increases. Neither is the wage a scarcity price in the sense that it rises of falls as the number of labourers per unit of Capital decreases or increases.

The second assumption not only denies Capital any mobility on the international plane, but does not allow at all for the fact that, with the exception of certain geo-climatic factors which are indeed given and immutable, factors of production are themselves produced within each country and consequently cannot be considered as inelastic, however immobile they are on the International plane.

When one points out that Germany’s traditional specialization in Chemicals is due to her availability of an abundance of chemists, we feel that the effect is somehow substituted for the cause. Nobody is a chemist by birth and it seems to us hard to admit that Germans have a congenital predisposition for handling test-tubes. Chemists have to be formed, “produced”, by picking them up out of the same rough human stock and it seems to us more likely that it is on the contrary because there are so many important Chemical plants in Germany‘ offering attractive jobs to chemists that a relatively high proportion of young Germans choose this discipline when entering University. As Kindleberger (Foreign Trade and the National Economy, Yale 1962) very adequately puts it, instead of making her foreign trade fit the proportions of factors, a country can modify these proportions to make them fit the orientations of her trade.

Factors of production are neither as immobile in space nor as immutable in time, as Heckscher-Ohlin assume them to be.

But the Heckscher-Ohlin theorem is not only theoretically unsatisfactory; it has also, in its main aspects, been challenged empirically.

-

After more than a century of expansion of international trade, not only is there not to be found at world level the slightest tendency of the equalization of factor revenues, but, moreover, if we consider the main factor of production, the labour force, we are faced with a continuous widening of the gap, at least of the gap between developed and underdeveloped countries.

Heckscher-Ohlin have reacted to these historical facts by outlining a set of factors which counterbalance the effects df their law: shift of techniques within the same branch, replacing a shift of branches, economies of scale, transport expenses, taxes, etc. all this, however, could explain a possible slowing down of the rhythm of the equalization of revenues suggested by the theory; it could by no means explain the actual existence of an opposite tendency towards a greater inequality.

-

All attempts made up to the present moment for a statistical verification of the theorem have failed. Furthermore, a thorough study of American specializations and exports, carried on by Leontieff, led to the unexpected conclusion, known henceforth as the Leontieff paradox, that the specializations and exports of a country as rich in Capital as the United States are on the whole and on average, labour–intensive and not capital-intensive.

INTERNATIONAL VALUE

As we have already seen, Ricardo was only interested in the process of specialization and in the advantage the whole system could reap from an international division of labour based on comparative costs. In so far as these reflect objective conditions of production, they set two limits between which actual terms of trade fluctuate: 8/9 cloth < one wine < 12/10 cloth.

James Mili, in his Elements of Political Economy (1826) was the first to notice that Ricardo had not solved the problem, that is, he had not answered the question about the way the two countries will share the advantage of comparative costs. However, he did not develop this point any further.

A few others, such as Longfield and Torrens, suggested that the point of equilibrium depends on the demand. But it was J.S. Mili, in Essays on some unsettled questions, published in 1844 and containing essays dated 1829 and 1830, who systematically dealt with the matter.

“…the exchangeable value of these commodities relatively to each other will adjust itself to the inclinations and circumstances of the consumers on both sides, in such manner that the quantities required by each country, of the article which it imports from its neighbour, shall be exactly sufficient to pay for one another …” (Mili, t. S., Essays on soıpe unsettled guestions, I. p.12).

However, it is in his Principles that J.S. Mili studies this question thoroughly. He then notices that in international trade the classical law of value which established a direct link between the rate of exchange of two commodities and their respective conditions of production is no longer valid:

“…the values of foreign commodities depend on the terms of international exchange. What, then, do these depend upon? …We have seen that it is not their cost of production… We must accordingly… fail back upon an antecedent law, that of supply and demand.” (J.S. Mili, Principles. II, p.122)

And some pages further on, he puts forward the notion of the elasticity of demand without using its name:

“If, therefore, it be asked what country draws to itself the greatest share of the advantage of any trade it carries on, the answer is, the country for whose productions there is in other countries the greatest demand and a demand the most susceptible of increase from additional cheapness.” (idem.p. 131)

So, it is the interplay of reciprocal elasticities of demand which determines the point between the two limits set up by the theory of comparative costs, where the actual rate of exchange will be fixed. J.S. Mili called this proposition the “Law of the Equation of International Demand.”

This law was afterwards further developed by Alfred Marshall in his work, The Pure Theory of Foreign Trade. By synthesizing these developments we can illustrate the theorem by the following diagram:

Line OL represents the upper limit of the wine terms of trade, viz., 1 wine = 12/10 cloth. OL’ represents the lower limit: 1 wine = 8/9 cloth. The two demand curves can only cross each other between these two limits. Other- wise, trade stops. Indeed, at 1 wine < 8/9 cloth, to the right of OL’ Portugal prefers to produce her own cloth rather than to get it through exchange. And at 1 wine 12/10 cloth, to the left of OL, England prefers to produce her own wine rather than get it through exchange. Point P, where the two curves meet is the actual rate of exchange, naturally situated between the two limit-lines.

If the demand for cloth (ODc) becomes more elastic, all other things remaining equal, its curve (dotted line) will move towards the right and will meet the curve 0Dw at P’. The cloth terms of trade will improve.

If this same demand becomes less elastic, its curve (dotted line) will move towards the left and will meet 0Dw at P”.

The wine terms of trade will improve.

Mutatis mutandis, if the demand for wine (0Dw) becomes more elastic, the wine terms of trade will improve, and in the opposite case they will deteriorate.

The problems and contradictions in the neo-classical theory of international value

We have seen how the classic theorists and after them the neo-classic theorists explained the formation of international value. On the assumption of the immobility of capital and men, they had admitted for more than a century that it was the prices of the commodities dealt with in international trade which determined the remunerations of their producers and not the other way round. It was a perfectly acceptable theory satisfying common sense.

It is the yield of man‘s economic activity which determines his earnings; one cannot conceive that it is his earnings which determine the yield of his activity.

How were prices themselves, then, determined? The answer to that question was given once and for all by the theorem of comparative costs of Ricardo and by the theory of demand (reciprocal elasticities) of J.S. Mili. The former set up limits to the movement. The upper limit was the price beyond which it became preferable for a country to produce for herself the imported article. It corresponded to the lower limit of the exported article and vice-versa, since imports were paid for by exports. Within these limits, the actual rate of exchange was fixed by the interplay of respective intensities of consumer needs for each commodity at stake. In short, this is nothing else than the law of supply and demand, the supply being expressed by comparative costs and the demand by human needs.

If that was so, the terms of trade should have moved. in favour of agricultural and mineral countries and to the detriment of industrialized countries. On the supply side, the geo- climatic advantage of the former is far more substantial than the technological advantage of the latter; on the demand side, the needs met by raw materials are much more pressing than the needs met by manufactures.

It would surely be very onerous for the Congo or Algeria to produce their own cars or transistors, but relatively less than it would be for France or England to grow groundnuts under glass, or to bore in every square foot of ground in order to draw oul? the last drop of oil. Besides, one can, if need be, do without cars or transistors; one can less easily do without oil or fats.

So, economists did not take long to draw the conclusions

which were consistent with their doctrine. all forecasts from Ricardo to Colin Clark, passing through Mili, Marshall, etc., (with a unanimity quite remarkable for a discipline in which nobody has ever agreed with anybody else) were unconditionally pessimistic regarding the fufcure of manufactured goods and categorically optimistic as regards the future of raw materials. all through the 19th century and up to the last war the belief in the existence of such a trend was the most unshakeable and unwavering element in economics.

The classical theorists had already made out of the forecast of the constant rise of primary product prices and the subsequent increase in the cost of the worker’s subsistence and wages the basis of their law about the tendency of the rate of profit to decline. Malthus, Torrens, Ricardo, J.S. Mili were categorical: as societies progress, a gap is created and widened between relative values of manufactured and primary products respectively, the price of the former declining constantly and the price of the latter increasing unceasingly.

Although considerably less explicit and not linking his own law of decline of the rate of profit with the movement of prices, Marx seems to share the core of the pessimism of the Ricardian school as regards the evolution of the prices of manufactured commodities. Later on, Bukharin pointed out that one of the causal factors of imperialism is the general and universal advance in prices of primary goods inducing a relentless struggle among industrial countries to secure their resources.

Marshall foresaw the day when backward countries, thanks to their primary products, would possess an inexpugnable monopoly in their international bargaining. Keynes, principally in the works of his youth, came to similar conclusions.

Figures were produced. In 1942, Colin Clark, in The Economics of 1960, forecast for 1960 an improvement of the terms of trade of primary products of about 90% as compared with the 1925-1934 level! And not only had contemporary scholars seen nothing paradoxical or reckless in such a forecast but some authors such as, for instance, E. Moret and H. Aubrey, extrapolated this data and extended this certainty of improvement up to 1970 and 1975!

An unmanageable reality

The publication, in 1949, of the famous study by the United Nations showing a 40% deterioration in the terms of trade of the countries of the Third World since the end of the nineteenth century, as well as later statistics, particularly after the Korean war, pointing to an acceleration of the movement, cruelly denied these prophecies. However, instead of giving up the idea of the determination of prices by demand and so enabling the theory to explain the reality, economists did their utmost to look for new and original elasticities of demand which would back up the faltering theory.

Without going into all the details of the debate, one can nevertheless say that the new peculiarities of demand, discovered in order to save the argument, are as unacceptable as the previous arguments and this for very simple reasons.

-

1)An unfavourable demand for primary products, if it ever existed, could in no way account for the deterioration of the terms of trade, given that what deteriorates, according to the statistics, is not the prices of primary products in general, but the prices of any commodity (either primary or secondary), exported by the Third World.

Now, if the majority of Third World exports are primary, the majority of primary products exported in the world is not exported by the Third World. For example, in 1970, 11% of the exports of the under-developed countries were primary, but 60% of the world’s primary exports were exported by the developed countries.

Developed countries produce and export many primary products, timber, various minerals, dairy products, wines, spirits, etc., whose terms of trade hardly deteriorate. Similarly, the Third World exports some secondary products, textiles, (among others) which, however secondary they may be, undergo the same deterioration as the rest of its exports.

-

2)With the passage of time, several productions have changed sides. Once, again the example is textiles. As soon as they became the specialization of under-developed countries, they started undergoing the same deterioration in the terms of trade which affects anything these countries decide to produce and export. By what coincidence can the tastes and needs of world consumers change at the very moment at which a change occurs in the location of production.

-

3)The demand which is in question here is the final consumer’s demand. It can only affect the retail price. Now, the only price which is of interest for the producing country is the F.O.B. price ((Free on Board)) . Between these two there is such a long chain of middlemen and, particularly, such an accumulation of taxes imposed by the consuming country and, consequently, such a gap, that the sensitiveness of the F.O.B. price to the effects of demand on the retail price turns out to be negligible or nil. When the F.O.B. price of coffee is something like 20 pence a pound and its retail price about 80 pence or more, when the taxes of the consuming country on oil amount to a multiple of 3 or 4 times the price received by the exporting country, can it seriously be maintained that it is unfavourable demand, at the level of retail prices, that prevents an increase in F.O.B. price? This would mean that the demand of the European consumer is patriotically elastic and obliging when the price differential accrues to the public Treasury of his country in the form of taxes, but it becomes inelastic and reticent as soon as this same differential is due to flow into the pockets of a foreign producer!

-

4)The world demand for mineral raw materials originating in the Third World, namely for oil and, to a lesser degree, for oil seeds, is to-day particularly intense. We are witnessing a dependence, which is steadily increasing, of developed countries on under-developed countries for their supplies in a certain range of vital materials. In a whole set of ores of prime importance, the geological reserves of the industrial countries are diminishing dangerously; in others, it is the percentage of pure metal contained in the ores which decreases considerably compared with those of the Third World (for example: iron ore). As to some agricultural products of the under-developed countries, (other than oil-seeds), such as coffee, cocoa, exotic fruits, etc., the matter is, in most cases, of luxury articles and as such they enjoy the advantage of an income elasticity of demand responding well to the rise of revenues in the consuming countries.

-

5)

–28–

World consumption of 11 Third

World products

In thousands

of tons

Yearly

averages

lb«9–1913

19^9

Groundnuts

1,800

16,630

Bauxite

1,000

53,960

Cocoa

232

1,422

Coffee

1,199

4,231

Palmoil and Palm Kernels

266

1,594

Phosphates

7,194

82,010

Cane-sugar (China excluded)

9,581

29,500

Tobacco (production of under- developed countries only) 1

565

2,857

Natural Rubber

100

2,900

Copper

900

5,940

Tea (China excluded)

288

1,048

23,125

202,092

In millions of tons

Oil (production of under-

developed countries only)

8.2

1,150

It is simply not true that the world consumption of agricultural and mineral products coming from the Third World was, in the 20th century, declining or stagnant, either in absolute or in relative terms. As one can see in the table below, in 11 products, among the most representative of third world exports (oil excluded), world consumption from 1913 to 1969, has multiplied by 8 1/2, increasing from 23.1 to 202 million tons, and, as regards oil, it has multiplied by 143, increasing from 8 to 1150 million tons. If the increase in value has not followed the same pattern, this is the effect of the deterioration in the terms of trade and cannot be its cause.

-

6)But it is another consideration that probably constitutes the strongest point against the thesis of price determination by demand. This is that there simply is no specific and autonomous demand for Third World. Primary products, since most of these products are used as raw materials in processes of further production located in the developed countries themselves.

Under these circumstances, the only demand which could be determining is the demand for the final product, since this is the only product which can be related to the consumer’s needs and which is affected by the various elasticities of demand. If this demand was unfavourable in any respect, it would depress the demand for the final product, fully and before any transmission of its effects to the raw material “upstream”. But this final product is a product of developed countries and enjoys, as such, the benefit of the excellent terms of trade of these countries.

Let us take the example of cocoa and examine the make-up of the retail price of chocolate in Italy and West Germany:

|

In percentage of retail price |

Italy |

West Germany |

|

CİP price of cocoa-nib |

12 |

10 |

|

Other constituents |

5 |

3 |

|

Custom duties and import taxes |

17 |

5 |

|

Cost and profit in the import activity and in the manufacturing process |

20 |

36 |

|

Gross charges of distribution |

46 |

46 |

100 100

We had better give up any idea of comparing what the consumer of chocolate pays with what the cocoa-nib grower receives. It may be granted that there is no common denominator to the two magnitudes. It nonetheless remains that cocoa-nib is the exclusive raw material (without possible substitution) of chocolate and that, consequently, the demand for cocoa-nib is but a derivative of the demand for chocolate. This means that the former must follow the latter for better or worse.

To say that the cocoa-nib price declines or stagnates because of an unfavourable demand amounts to saying that the demand for chocolate is slack. But if the demand for chocolate is slack and if it is the demand which determines the price of the product and, subsequently, the earnings of the producers, one cannot see clearly how it is that the same demand for the same final product determines rates of wages as different as those of cocoa growers in Ghana and those of chocolate factory workers in Europe, the latter being 20, 30 or 40 times the former, all differences in qualification and skill having been allowed for.

Nothing essential would be changed if the entire process from the cocoa-nib fields in Ghana up to the supermarket in Germany or in Italy, passing through the chocolate factory and the conditioning and packing processes, was controlled by a single enterprise whose workshops were thousands of miles away from one another. It would then become quite clear that if demand determined anything it would first of all determine the same rate of wages through the whole chain.

Actually, at each stage, the price of the output of the stage is, on the contrary, formed by local wages, on the one hand, world rate of profit on the other, plus the price of the output of the preceding stage. If this is what happens in the real world, this means that the determination is going down, from “upstream” towards “downstream”, and not in the opposite direction. Now, demand springs from downstream.

The demand for raw material could perhaps be dissociated from the demand for the final product, only if there were substitute raw materials produced, or capable of being produced, within the developed countries themselves. These do not exist, at least not for the major part of raw materials coming from the Third World, despite a widespread belief to the contrary. In any case, it is certain that there is no commercially valid substitute either for cocoa or for oil, or a certain number of other products, even if there are substitutes for some other materials. Yet both categories of products undergo exactly the same deterioration of their terms of trade.

The other way round, there scarcely exists an export article of developed countries which does not contain some material coming from the Third World. Finally, one can roughly say that international trade generally exchanges industrial commodities against their own constituents: chocolate against cocoa, soap against fats, steel against iron ore, tyres against rubber. Since for each couple there is only one single demand in operation, to claim that the variation of the terms of trade is determined by a characteristic of the demand becomes an unintelligible proposition.

We can therefore conclude that the phenomenon of the long run deterioration of the terms of trade of Third World exports is unexplicable within the framework of prevailing ideas and all attempts which aim at saving the essentials of traditional theory by putting forward new inelasticities, or lack of elasticity of demand, seem quite vain to us; and more so as the matter is of post-factum adjustments with a view to accounting for troublesome historic facts. The contradiction is unavoidable. Only a thorough revision of the theory will make the Science cope with the reality.

This revision cannot be made unless the causality is turned upside down. One must then reject any determination arising “downstream” and look for determining factors “upstream” in the production relations themselves.

And this is of prime importance. Because if it was deficient demand which was responsible for the prices of Third World exports, and if it was these prices, normally formed in the world market, which, in turn, determined the incomes of the producers, their increase by artificial means, namely by state-to-state agreements between producing and consuming countries, would constitute a liberal goodwill action, at best a moral duty, of rich countries. Now it is clear that present under-developed countries do not mean to make an appeal to the generosity of industrial countries. Their claims look much more like attempts to recover something that has been taken from them than like anything else. When one reads, for example, the programme of action that the underdeveloped countries have drawn up on the occasion of their last Santiago meeting, one is impressed by the clarity with which this document puts forward the principle of the responsibility of rich countries in the present situation. It is therefore to be asked whether Science will continue to ignore this consciousness-raising.

The determination of the terms of trade by the relations of productıon.

We think it would be better to pass quickly over the theses which explain the terms of trade by the influence exercized on the world market by monopolies. To be sure, we do not want to under-estimate the existence of certain price distortions due to monopolistic practices, but:

-

1.once the brief statement has been made that prices are such because monopolies have made them such, there is nothing very substantial to add.

-

2.It seems to us illusory and even inconsistent with our own criticism of comparative costs to believe that the situation of under-developed countries could be substantially improved by the elimination of monopolies and the resuming of pure free-trade.

-

3.It seems furthermore dangerous for the Third World to make itself the Champion of free-trade. Industrial countries would certainly not dislike this, particularly in certain fields such as oil.

If we disregard monopoly prices and if we reject, as we have already done, the neo-classical theory which explains prices by the peculiarities of reciprocal demand, there remain two theses to consider: the thesis of the differences in labour productivity, and the thesis based on the exogenous distribution of income, that is, unequal exchange.

The determination of international prices by differences in labour productivity.

This thesis has been mainly presented by some Marxian economists in the Eastern bloc within the framework of a tendency to rehabilitate Ricardo’s theory of comparative costs. The protagonist of this rehabilitation was indisputably Gunther Kohlmey of the Faculty of Foreign Trade in East Berlin. He has been followed quite closely by other economists of the Eastern bloc especially Hungarians.

One can enunciate the essential points of this theory in the following manner:

Just as on the national plane each commodity has several individual values (according to the conditions prevailing in each unit of production), but only one social value, so also on the international plane each commodity has several national values related to labour productivity in the different countries producing it, but only one (average) international value.

Given that the value is inversely proportionate to the labour productivity, the national value of under-developed countries (less productive) is greater than the international value, whereas the national value of the same commodity in developed countries (more productive) is smaller than its international value.

|

National value in underdeveloped country |

> |

International value |

> |

National value in developed country |

It follows that when a developed country exports a product, it gains, by selling it at its right international value, the want of its national value as compared with the corresponding international value. When an underdeveloped country exports a product it loses, by selling it at its right international value, the excess of its national value over its international value.

These economists argue as if, in international trade, there were no other commodities than industrial products, in which the productivity of labour in underdeveloped countries is often (but not always) inferior to the productivity in developed countries. They simply ignore the mineral and agricultural products exported by the Third World countries in which these countries enjoy an overwhelming superiority. Their analysis is on the whole correct as regards the commodities imported by underdeveloped countries; it is incorrect as far as the exported commodity by these same countries is concerned. Regarding this latter commodity, the above inequalities are reversed:

|

National value of underdeveloped countries |

< |

International value |

< |

National value of developed countries |

In fact, we have here not only a rehabilitation of the theory of comparative costs but, moreover, an unskilful one, for what was just a simplification in Ricardo’s presentation becomes with these economists the essential element.

Indeed, Ricardo assumes that one of the two countries in his example is more productive in both commodities involved. But this all-embracing superiority of one country over the other is neither a sine qua non of the law of comparative costs nor a realistic hypothesis.

If a British car costs 500 hours of labour, it is plausible to assume that the same car could cost 1,500 or 2,000 hours if it were to be fabricated in Ghana. It follows that if the International price ought to be situated somewhere around the average of the two values, one understands easily that Britain. gains the difference. (One understands less easily what Ghana loses in the deal). But if one ton of cocoa costs Ghana 200 or 300 hours of labour, it is just as plausible to presume that the same ton of cocoa would cost several thousands of hours of labour if it were to be produced (by artificial means) in Britain. We should conclude, according to the logic of this theorem, that Ghana, by selling Britain one ton of cocoa at a price between the Ghanaian and British costs, gains considerably more than what Britain gains by selling Ghana one car under similar conditions. In comparison with the reality, we are very wide of the mark.

Unequal exchange

We have seen the deadlocks to which we are led by the prevailing doctrine of comparative costs and the doctrine of the determination of international value by the interplay of recriprocal demand.

In the presence of a reality so diametrically opposed to the theory, it seems necessary to abandon any idea of patching up the theory but rather to turn it upside down by refuting its most basic hypotheses.

These hypotheses are two:

-

1.Determination of the prices of factors by the market.

-

2.Immobility of the two main factors, labour and Capital.

The first hypothesis enables one to allow the distribution of income to depend on external prices; the second makes it possible to set up, from country to country, different prices for the same factor.

Regarding the first hypothesis one must distinguish the classical point of view, that of Ricardo, from the Marxian and at the other end, from the neo-classical view.

For Ricardo, the only factor whose price could vary from country to country in accordance with the return from foreign trade was Capital.

On the contrary labour was paid everywhere the physiological subsistence minimum. Granting that this minimum could differ from one region to another because of climatic causes, this differentiation was not linked to the prices of goods and to the hazards of foreign trade.

Consequently, any advantage or disadvantage connected with foreign trade was reflected in corresponding variations of the other factor, that is, the rate of profit prevailing in the region under consideration.

The disparity of profit rates from one country to another was made possible on the basis of the hypothesis of the international immobility of Capital. This does not mean that for Ricardo labour was mobile. But the degree of its mobility was irrelevant. For the theory to work it was necessary and sufficient that Capital be immobile.

Therefore, from Ricardo’s point of view, the price of labour was an exogenous price; the price of Capital was a residue. As such it was the only magnitude to be affected by gains or losses occurring in external relations.

The prices of factors in the Marxian system

The introduction of a moral and historical element among the factors determining the value of labour-power make things change fundamentally with Marx. As the class struggle, and more generally, the relation of power between social classes fill a large place within this moral and historical element, they become the main determinant of the distribution of income and, consequently, of the price of labour power.

As regards the influence that this income distribution can have on values and prices, Marx tackles this problem only as far as the national framework is concerned. He left the formation of the international value to be dealt with in the chapter about the world market and foreign trade which he planned for the end of his work and which he never managed to write.

On the national level, we must distinguish:

-

a)the theory of simple value

Here, the income distribution has no influence on the formation of value.

Any variation of the value of the labour power entails an opposite variation of the surplus-value, the value of the output remaining unchanged.

-

b)the theory of prices of production

Here, on the contrary, any variation of wages gives rise to a variation in the same direction in the branches whose organic composition is lower than the social average, a variation in the opposite direction in the branches whose organic composition is higher than the social average and no change at all in those branches whose organic composition is equal to this average:

|

c. |

v. |

s. |

Rate of profit |

Profit |

Price of prod. |

|

90 |

10 |

10 |

20% |

20 |

120 |

|

80 |

20 |

20 |

20 |

120 |

|

|

70 |

30 |

30 |

20 |

120 |

|

|

240 |

60 |

60 |

|

||

|

50% increase of wages |

90 |

15 |

5 |

1/11 |

9 |

6/11 |

114 |

6/11 |

Decreases |

|

80 |

30 |

10 |

10 |

120 |

Unchanged |

||||

|

70 |

45 |

15 |

10 |

5/11 |

125 |

5/11 |

Increases |

||

(Ricardo in chapter IV of his Principles had put forward the same theorem under a different form).

Consequently, while values depended only on material, physical, conditions of production, prices, according to Marx and Ricardo, depended not only on these conditions but also on the distribution of income.

But this concerned only national value and prices, that is, the magnitudes formed within an area where both factors were competitive, this competition entailing two equalizationş, that of wages and that of the rate of profit.

Neither Ricardo nor Marx have extended this determining power of the distribution of income into the international plane, the former, because he considered Capital as immobile and therefore the rate of profit as not being subject to equalization on the international level; the latter because he had nowhere systematically tackled this question.

International value Neo-classical Theory

What was perhaps a correct hypothesis in Ricardo’s time, namely the immobility of Capital, became unrealistic with the neo–classicals, that is, in the third quarter of the 19th century. Yet, the neo-classicals grappled with it and continue to do so.

Besides, the neo-classics rejected not only the Ricardian determination of wages in terms of a subsistence minimum, something which indeed had meanwhile lost all realism but even the Marxian determination in terms of class struggle and power relations.

Against this background, determinations can only proceed from “downstream”.

The State of international demand determines the prices of export products, the prices of these products determine the level of national revenue, the level of the national revenue, namely the total of factor earnings, jointly with the relative scarcities of these factors, determine the distribution of revenue, and therefore finally, wages and profit. One is poor or rich because one sells cheaply or dearly. If Arab countries are poor this is because they specialized in oil, the terms of trade of which have been falling for the last three quarters of a century ((This was written before the last authoritative rise.)) . If Sweden and Canada are rich. this is because they produce and sell timber, the terms of trade of which are constantly improving during the same period, and so on. Prices are given, the cause; factors earnings, the effect.

The reversal_of the assumptions.

The dominant economic doctrine outlined above ignored two historic facts.

-

1.A particularly efficient trade-union movement since the end of the nineteenth century, in the developed countries, coincident with

-