I have spoken here and there in my book of Third World exports from branches with a very high technological level, ultra-modern textile factories in Egypt and India, Katanga’s rains, etc., which, like the others, and despite their high productivity, suffer from the inequality of exchange. I also mentioned certain stagnant branches of the developed countries (Scottish whisky, certain semi-artisanal fabrics, etc.) which benefit from the same inequality, despite the low level of productivity; but it is true that I did not insist on this point and for good reason:

- It cannot be said, however, that all or even the majority of Third World exports come from these technologically advanced branches. However, unequal exchange is in no way subordinated to the relative importance of these branches.

- Within the developed countries, there is a very great disparity in interregional development. Trade between regions is nonetheless essentially equivalent, as you yourself note (p. 21 of Chapter 1).

3) As in the framework of the nation, so in the framework of the world, the potential for applying technological progress is necessarily limited (by the existing fund of accumulation) and, for one reason or another, this fund is unequally distributed geographically. This is no reason, either nationally or internationally, why the remuneration of the factor – labour – should be unequal for equal qualifications and intensity. If we imagine a truly universal socialist system without any exploitation of man by man, it is not certain that this system will disperse the equipment it has to the five continents. It is theoretically possible that the optimum of this unified world will require, on the contrary, the concentration of these limited means in a few particularly favourable regions. This will not be a reason to differentiate the living standards of men according to the location of the machines. Already in the

In the capitalist system, no one conceives of such a differentiation, for example, between the southwest of France and the over-industrialized Paris region.

- Sometimes, when we talk about productivity, we actually mean profitability. To make prices and wages depend on profitability is to reason in a circle, since profitability itself is a function of prices and costs. If, on the other hand, we are really talking about physical productivity, we must note, on the one hand, that prices, far from being an increasing function of productivity, are, on the contrary, according to the law of value, a decreasing function of productivity; on the other hand, that between different branches physical productivity is incommensurable. To make it comparable, some economists (see Palloix) use the organic compositions of capital as indices of productivity. Some passages of Marx corroborate this view. But if the difference in organic compositions were to determine the scale of wages in the various branches, then the French hairdresser or taxi driver would have to earn a wage some hundred or two hundred times less than that of a French metal worker. This is absurd; not all branches have the same capacity to absorb technical progress and mechanization, but humanity, like the nation, needs all these branches and someone has to work in them.

- I did not dwell on the chapter on productivity, not only because I considered it irrelevant to my subject, but also because I did not suspect that the unconscious influence of marginalism was so great, and that so many economists claiming to be Marxians reasoned on the basis of productivity as a determinant of the value of labour power and wages. This is the essential difference between the neo-classical theory of value and the objective theory of labour-value. Beyond that, the

– Z –

In the neo-classical school of thought, it is the use value that determines the price of everything, including labour power. Since the use value of labour power is nothing other than its (marginal) productivity, it was natural and coherent for this school to make the wage depend on the productivity of labour, that is to say, ultimately on its utility, on the results of the consumption of labour power. Marx vigorously and repeatedly protested against this conception, which holds to the appearance of things and treats the value of labour power as the price of its function. The value of commodities according to Marx, and even according to Ricardo, depends not on the conditions of their consumption, but on the conditions of their production. The commodity “labour-power” is no exception to the rule. The conditions of its production are to be found in the human organism on the one hand, and in the branches which produce subsistence goods on the other. What happens in the branches in which labour power is used by its purchaser (employer) is not relevant to its value. That is what the concept of labour power is for. What the employer buys is not the labour, but the labour power, which is more or less productive, depending on the conditions of its use and the equipment to which the worker is attached. Labour power has no productivity. It is a neutral vital energy and its value is already constituted before we even know where its purchaser is going to use it, in the handling of a million dollar press or a handcart.

- The determining power of comparative productivities in the Ricardian theorem may be confusing, but it is something else entirely. Under Ricardo’s assumptions (immobility of capital), it is true that, all other things being equal (demand elasticities), the ratio of productivities does indeed determine a difference in factor remuneration. But this is not the ratio of productivities in the traded items (productivities that remain incommensurable) but the ratio of the productivity ratios of the two countries respectively in each of the candidate items for exchange (perfectly commensurable ratios).” In other words, if the underdeveloped country exports oil and imports cars, it is not a question of comparing the productivity of the oil industry in the underdeveloped country with the productivity of the car industry in the developed country (an impossible comparison), but of comparing the difference between the productivities of the two countries in oil with the difference between the productivities of the two countries in cars, if the two countries were to produce both items in isolation. It is thus a question of comparing for each country its advantage over the other country in the exported item with its disadvantage over the other country in the imported item.

If we make this comparison (the only one possible), we shall see that the superiority of the underdeveloped countries in their backward production is generally much greater than the superiority (or rather the lack of inferiority) that you seek to establish by calculating in absolute terms the productivities in the modernised branches of these same countries, not to mention the fact that in order to do this you are obliged to resort to an artifice, that of trying to quantify physical productivity by means of the organic composition of capital, which is, at best, only a qualitative index.

For, finally, (a) not all the exports of the underdeveloped countries come from enterprises as well equipped as United Fruit, Unilever or Union Minière du Katanga, (b) even in these enterprises, the technicality and the organic composition of capital are not on the whole so much superior to the technicality and the organic composition of capital of the enterprises of the developed countries – one within the other – which export to the underdeveloped countries. On the other hand, if we consider comparative productivities, the only ones invoked by the neo-classicalists (to whom we must respond, since consistent Marxists do not pay any attention to productivities – absolute or comparative – in determining the value of labour power), we find that, on the whole, the advantage of the underdeveloped countries in the exported article is infinitely greater than their disadvantage in the imported article, and it is precisely not in the advanced sectors where this difference is most marked. No matter how modernized, textiles in Egypt or India are not, on the whole, much better than those in the United States or Europe. At best, the one is practically worth the other. On the other hand, however primitive it may be, the cultivation of coffee or bananas in Africa requires considerably less labour (and not only cost) than would have been the case in Europe or North America. Wages in the Third World would increase twenty or thirtyfold tomorrow, but the developed countries would not start to set up greenhouses to produce coffee or cocoa, or to raise elephants to produce ivory. They would continue to buy them from the Third World. The same cannot be said for textiles or certain minerals, for example.

This is why I cannot accept “equal productivity” as a restrictive condition, as your folrumations sometimes imply, notably on page 44 of the Introduction and on page 28 of the first chapter. In this second place, you write: “… inequality of exchange when – as is the case – with equal productivity labour is paid at a lower rate at the periphery.” Moreover, here there is an absolute contradiction with what you say on page 22 of the same chapter where you qualify the exchange as unequal only because of the difference in productivity even though wages are supposedly equal. I will come back to this last point,

II

You say, that the transfer of value from unequal exchange is trea heavy for the periphery, mata marginal for the center (p. 45 of the introduction). In a point-in-time accounting sense, you may be right, though I’m not sure we calculate it the same way. However, the wage gap does not only lead to a deterioration in the terms of trade. It also leads to : (a) a substitution of factors in the opposite direction, machines tending to replace expensive labour in the centre and cheap labour in the periphery tending to drive out the machines; (b) a harmful orientation of investments in the “lightest” branches both from the point of view of the organic composition of capital and that of labour, branches made more profitable already, and all other things being equal, by the wage gap alone; (c) a “perverse” flow of capital away from the too small markets – because of the low wages – of the periphery and towards the expanding markets – because of the high wages – of the centre; (d) a drain of men towards the centre – skilled workers and technicians – at working age, therefore, with all training costs borne by the periphery; (e) a cumulative effect whereby each of these factors has a retroactive effect on the others.

You are right to note a difference in this respect between my book and my article. In the former, the subject was specific; unequal exchange, therefore, the only mechanism of transfer through prices (it is the primary mechanism from which all the others flow); in the latter, the subject was the global enrichment of the centre at the expense of the periphery. I do not think that this enrichment, given the effects of all the above factors and their cumulative interaction, is marginal, or else economic imperialism is also marginal. For, apart from direct tribute, I can think of no other way of enriching one country at the expense of another. Do you know of any?

III

I agree with you that the bourgeoisie of the periphery is not exploited, (p.^0 of the Introd.). How could it be? If I have somewhere implied such a thing, it is a serious mistake.

I believe that the antagonism between the proletariat and the “national” bourgeoisie in the countries of the periphery is as irreducible as a class antagonism can be. This is not the case in the countries of the centre. There, in my opinion, there is a clear trend towards national integration. This does not mean that there are no more internal contradictions in the rich nations. There are some, and they can even sometimes take on extremely violent forms (see certain trade union struggles in the United States), but they are no longer irreducible. (I call an irreducible antagonism when the share of some can only improve in strict proportion to the deterioration of the share of others). They are constantly transcended by the national pact.

The term “aristocratic nations” (p.SI of the Introd.) is literary, I grant you. It is true that there is a world bourgeoisie and a world proletariat. But there is also a world labor aristocracy. I didn’t create this appellation. It was “controlled” by Engels a century ago, theorized by Lenin and Bukharin over half a century ago. There is nothing in this theory that allows us to set quantitative limits to the workers’ aristocracy. Its limits are historical and contingent. There is nothing to exclude the fact that in this or that country at this or that time it encompasses the majority or even the entire working class of the nation, the concept of the world proletariat will not be altered by this. And we do not have the right to accept Lenin and Bukharin’s theory of the workers’ aristocracy for the period when it was of interest only to the minority of the working classes of certain nations, and to reject it when it happens to be of interest to the majority of these classes in another period and to disturb us terribly. But I do not think that our views differ fundamentally on this point.

Bortkiewicz’s thesis is not a minor correction. I believed it myself for a long time and treated it as such in my book. I have since changed my mind.

This would be a minor correction if Bortkiewicz’s formula had solved the “transformation” problem. I am now convinced that this is not the case. I believe that the “transformation” of values into production prices is properly impossible. It is not a question of a difference in calculation. It is a question of jumping from one principle to another, namely, from the determination of exchange value by the quantities of the factors or of the factor to the determination by the remunerations of the factors, It is a question of a change of content and not of a change of form. To treat this passage as a change of form, a “transformation”, is a logical antinomy, and neither Marx’s nor Bortkiewicz’s schemes could achieve it. In a market economy, it is only the remuneration of factors that counts for the exchange of commodities and for the distribution of social labour in the different branches. Any reference to the material support of an absolute value, of which production prices are only one of the avatars, is as mythical as the ether of the physicists was once. It is not without reason that the chapter on the prices of production, written before the second book and logically supposed to follow and complete the first (or at least the second, since normally it was necessary to construct the schemes of extended reproduction and realisation of the product in prices of production and not in values), was relegated by Marx to a third book, the existence of which he concealed from everyone, including Engels, until his death, that is, for about twenty years.

This is too broad a topic to be discussed here. It may have to be discussed at a separate time. I’ll come back to that later.

Concerning my controversy with Bettelheim on unequal exchange in the broad sense (equal rates of surplus value, unequal organic compositions), I don’t quite understand your developments. You begin by saying that this exchange is not unpleasant (p.21). Then, on page 22, you say that it is nevertheless unequal, and to demonstrate this, you present a very specific diagram in which two countries produce and export (no doubt to third countries) the same article under conditions of unequal productivity. At first we don’t see where the exchange is, then you yourself come to the conclusion that in these conditions the rates of surplus value cannot be equal and you then rewrite your diagram in this sense. So how can you keep your original statement that despite equal rates of surplus value, the exchange is unequal?

I agree with you completely that it is not market forces that account for the living wage in the periphery (p. 29) – I don’t even think that the labour market has ever really worked anywhere, but obviously even less so in the underdeveloped countries. As a general rule, I believe that wages are determined much more by the relationship of social forces than by the play of supply and demand.

Concerning what you say about trade and the international division of labour in the socialist camp (gg. 29-30), I agree with you that, things being as they are, Romania is right not to accept the specialisations which its partners allocate to it. But this position, which goes against the general optimum of the socialist camp, is due, not only and not mainly to uneven development, but to the existence in socialism of separate and independent states. Why doesn’t Romania accept to despecialize, for example, in oil? Essentially, because oil, being the export product of underdeveloped and low-wage countries, is disadvantaged in international trade. At first sight, one could object that if it were only that, the other socialist countries could offer it compensations, possibly in the form of preferential prices. This answer would be unfounded. Because these compensations could only be established by state-to-state treaties, and such treaties do not offer a sufficient guarantee for the future. Only integration, only an organizational merger into the whole can be a sufficient guarantee. There was also uneven development between the different regions of the tsarist empire. This was not a sufficient reason for Kazakhstan or Uzbekistan to demand their own blast furnaces, their own metallurgical, chemical and other industries. And it would have been absurd for the Soviet Union to distribute its heavy industry or its industry at all equally and proportionally throughout the territory. What interest can the formerly peripheral regions have in asking for such a dispersion, when within the Federation the economic product is distributed by a single management and legislation? Why can’t Bulgaria or Romania accept the specializations that Kazakhstan or Uzbekistan do? Simply because the former are not like the latter Soviet Republics, but are separate Republics.

It is too often forgotten that this is a completely new situation from the point of view of revolutionary Marxism. When we spoke of socialism in several countries, no one had ever imagined the existence of several socialisms-in-one-country. Stalin himself conceived (at least before the last war) socialism in one country only for the first socialist country and waiting for the revolution to be made in other countries.

Nevertheless, if we consider the nation as a constraining reality that socialism itself cannot overcome and that it will take several generations to do so, I agree with you that the only way to unify the world is to first equalize the national levels through self-centered developments. But it certainly does not escape you that these “self-centred developments” will be to the detriment of the world optimum and cannot be done without friction. This shows once again that the national fact, which the Marxists had seriously underestimated, constitutes a source of contradictions in the world which the class struggle does not automatically resolve.

On page 51 you say that monopoly makes the phenomenon of the labour aristocracy possible. I don’t know what you mean exactly by that. On page 85, you return to this subject by speaking of “mechanisms which enable monopoly capitalism to ensure a continuous growth of wages at the centre”.

If you mean to say that not only do the external surpluses enable the monopolies to provide this growth, but that the monopolies as such react in a more realistic and positive way than competitive capitalism to workers’ demands, it seems to me that this is indeed correct. In the nineteenth century, many strikes ended in total defeat for the workers; in general, the strikes lasted a long time and the workers obtained practically nothing without striking. Today, there are few strikes in which the workers have obtained nothing, and very often the unions obtain a great deal by negotiation alone and without a strike. It seems certain to me that the contemporary large firm offers less resistance to union demands. It is a matter of fact that the big firm of today is less resistant to union demands because it controls a large part of its market, it is more or less in control of its prices and less sensitive to the increase in costs caused by wage increases. Through its connections with other large firms in other industries, it knows that the additional revenue it distributes as a result of a wage increase expands its own market, its own or that of sister companies, and in the end returns to it. Being much more integrated than the small individual firm in the space of the national economy, it has microeconomic rationality and motives from the outset. On the other hand, it is less prone than the old-fashioned boss to impulsive, passionate and irrational warmongering. It calculates coldly and seeks social peace for which it feels more or less responsible. She knows that she is being scrutinized by public opinion and is concerned about reputation.

On pages 69 and following, you speak of “export of capital”, whereas your figures refer to the assets that certain countries have accumulated abroad at different times. While establishing the progression of these assets, these same figures show that, at least in the period 1880-1915, there was no net export of capital, but on the contrary, a net import. If we take the example of England, we find that at a 5% rate of return – which is quite modest – the £1,000,000,000 of 1880 becomes £6,500,000,000 in 1911. The assets of England in 1915 being only £5,76 million, the repatriation of funds to England during this period exceeded the outflow by some £2,800 million, which is corroborated by the fact that England’s balance of trade was in deficit during the whole period. (The same calculation for the previous period, 185^-1880, shows that if there was ever a net outflow of capital from England, it was before 1880, not after.) Moreover, on pages 8^-85, you admit that 1′”export of capital generates a return flow which tends to outweigh it.”

I really liked your second chapter: “The formations of peripheral capitalism”. Your developments helped me to go deeper into questions that I had only touched on before. It is possible that in deepening them, I diverge somewhat from your conclusions on some points of detail. But I think I am in full agreement with you on the essentials. First, of course, that the feudal mode of production does not follow naturally from the disintegration of the slave mode of production (k;10). Are you sure that this is only a “version”? That the great classics of Marxism did not make this mistake?) Then, on the fact that the essential difference between the tributary (“Asian”) community and feudalism, consists in this, that in the first case the exploited is the primitive community itself, collective owner of the soil, while in the second, it is the individual peasant. (p.11). I would add that the primitive community, whether tributary or not, is not only the collective “owner”, but also the collective exploiter of the soil, which means that it is at the antipodes of market relations, whereas under feudalism, market relations already exist, not only in the fringe of freed artisans, Jews, etc., populating urban agglomerations, but also between the enslaved peasants and between them on the one hand, and the city, on the other.

I also quite agree with you that what constitutes the presupposition of the emergence of capitalist reports is the “proletarianization” of peasants, that is, their separation from the land… But, as you say, this separation is much more difficult in the case of the tributary community, where the link of man with the land is based on the very structures of the community to which he belongs, than in the case of feudalism, where these links are based on an external constraint, notably serfdom.To pass from feudalism to capitalism, it is sufficient, if all the other conditions are met, to (1*) abolish serfdom, which not only meets with no resistance on the part of the peasants, but is the very act of their liberation, (2*) transform the “eminent” property of the lord over the “commons” into “common” property. This second act naturally met with very strong resistance from the peasants, but it was an act of violence unique in its essence, which was, all things considered, easier, it seems to me, than the breaking up of a truly primitive community. On the other hand, already the abolition of serfdom, in which the peasants are “taken”, and without the “enclosures”, frees from the soil and therefore proletarianizes a certain number of peasants, without mentioning the escapes that produced proletarians already before the abolition.

I wish you had put more emphasis on the structures of the primitive community and the toughness of these structures, which I believe is something unassimilable for a European mind conditioned by a thousand years of tradition and mercantile stagnation, even if at the level of cerebral apprehension, Marxists admit its “remote” existence. I have personally had the chance to experience the community man in the “customary centres” of the Congo, where, despite the corrosion and the ravages of external aggression from the slavers to the modern colonialists, this man stubbornly refused to sell himself, to proletarianise himself, and was in fact only mercantilised on the surface.

As I said at the Anthropos meeting, I wonder if from a macro-historical point of view there are only two major social formations, the communal society and the market-capitalist society. These are two formations that can be conceptualized, despite the historical impurities that accompany them. All that intervenes between the two, in one direction or the other, would only be systems of transition that are fairly elusive and vary ad infinitum, that seem to belong to micro-history and that succeed one another and overlap according to the contingencies of reality. At the very most, we have in the passage from one to the other of these two major formations the real qualitative leap, in comparison with which all the other “revolutions” from slavery to feudalism or the reverse, the “bourgeois” uprisings and even the passages from traditional capitalism to the regimes of “socialist transition”, state capitalism, state socialism, etc., seem quite derisory and, moreover, escape any clear definition up to now.

IX

(p.Jl) As you very well put it, it is not the demographic law that generates unemployment, disguised or not, in the underdeveloped countries, but the impact of trade relations with the more advanced countries, one of the most characteristic consequences of which is the elimination of craftsmen by the influx of foreign industrial products. Naturally, a neo-classicist would tell you that this elimination can only take place if these foreign products are cheaper than local handicrafts; that in this case the quantity of agricultural products given in exchange is less than before; that this enriches society. But you give the answer on the page: Since the level of consumption does not rise and there is no accumulation, this theoretical “enrichment” is in fact translated into a decrease in the overall quantity of productive work, productive artisans being thrown into unproductive occupations in a parasitic tertiary sector.

But I cannot follow you when you say that the narrowness of the domestic market has nothing to do with this “blockage”. Let’s see; the agricultural surplus can now pay for more industrial products than it could previously pay for artisanal products. So, with equal global social consumption, we now have a surplus that can be used to import some equipment and thus establish, to begin with, some final goods industries. This surplus necessarily takes the form of market capital, since it is in the exchange, agricultural products – industrial products, imported, that it is captured. Whatever the nationality of the holders, this capital is realised in the country and, all other things being equal, has, a priori, the vocation to try to do so. On the other hand, the proletarianization of the craftsmen can provide the necessary manpower. We have here, then, all the objective conditions conducive to incipient capitalism, as you yourself have described them in European capitalism. The fact that foreign industry already exists and has an advantage should not be an insurmountable obstacle, as it was not in France and Germany with regard to the pre-existing English industry. If it is not an exclusive natural factor, this advantage – already partially compensated by transport costs and by the difference in wages – can be compensated for the rest by the customs protection of the “infant industry”, as has happened in all countries. That local bourgeoisies already oriented towards import-export activities may object strongly to the adoption of such a customs policy, I can easily understand. But, (1*) you should have said so – your own point of view would gain -, (2*) this cannot be the general case; these bourgeoisies cannot materially be victorious always and everywhere. If the branches to be established were really profitable from the point of view of the native search o foreigners, dissidents, outsiders, non-committals, who would have exerted the necessary political pressure for the adoption of a self-centred economic policy, since, under the objective conditions assumed, it does not take much in the way of protection for this or that particularly profitable branch to get through the period of its infantile difficulties. This is how all countries have made their first steps in industrialisation, and this is exactly what happened in the Third World and especially in Africa with textiles. If there was anything that clashed head-on with the interests of European merchant capital in the African colonies, it was the installation of textile manufacturers, since fabrics constituted a large part (in some colonies more than 10%) of imports. But the textile industry passed.

Many of these textile factories were the work of outsiders. In the Belgian Congo, with the exception of Utcxléo and Filtisaf, the textile industry was set up by Jewish capitalists from Rhodes; in Uganda, Kenya, Tanzania by Pakistanis etc.

I therefore believe that, while we must not underestimate other blocking factors – and I may have been guilty of this – we must not deny that the quest for profit ultimately prevails and that the determination that ultimately prevails is that of profitability. Profitability itself, however, is determined primarily by the size of the market. I have been personally involved often enough in various industrial installation projects in Africa to know from experience that in any such study, the first thing the financiers looked at before anything else was the importance of the market. I note that on the ZOS page you yourself acknowledge that “the smallness of the markets” is, along with the colonial pact, “at the origin of this delay” (of industrialization).

You go, I think, too far on this point, starting however from a correct foundation, namely, that the underemployment of factors is in the periphery of a completely different nature than in the centre and that consequently, any application in the periphery of the theories and techniques of inciting consumption of the Keynesian multiplier type is aberrant, (p.1^8). This is absolutely correct, but it has nothing to do with our problem, which is not the cyclical and dynamic linkage of the consumption curve with that of investment, but those prior outlets, the very possibility of whose existence you deny, because “the volume of the total outlets for production cannot, at any given moment, be greater than the volume of production itself. Let me consider this passage (p.70) as a mere slip of the tongue, because you simply forget about imports. It is not a question of satisfying a purchasing power which would be in excess of the value of production, but of manufacturing locally what is imported, and either modifying the composition of imports (more equipment and fewer finished products), or reducing exports by a corresponding amount, or both.

But, while maintaining the decisive determination of the search for profit and profitability, it is certain that, for my part, I have overemphasized one of their constituent elements, namely the dimensions of the market. Reading your book made me see this mistake. It is not only the market conditions that play a role, but also: (a) within the branch itself, the choice of possible techniques – heavier or lighter – according to the pre-established remuneration of factors in the country under consideration, and not to the relative scarcity of invoices according to the Heckser-Ohlin theorem; (b) the choice of the branch itself, according to the organic compositions of capital and labour that it is able to contain, always according to the existing remuneration of factors. You yourself accept the essence of this analysis on pages IL) and following.

If textiles were the first industry to be established on a large scale in the Third World, it was because its differential profitability was based on the three considerations listed: (1) sufficient domestic market, taking into account the fact that under conditions of poverty, two or three basic items, unbleached cloth, drill khaki, constituting by themselves the greater part of local consumption, were sufficiently uniform to enable a relatively modest unit of production to be devoted exclusively to them in the smallest country, (2) organic composition of capital low enough for low wages to have a significant effect on cost (J) organic composition of labour also low enough to enable the low wages, which concerned mainly low qualifications, to be taken advantage of. Thus, in the final analysis, it is the low wages that have conditioned the “rejection” of textiles from the centre to the periphery.

But it is not only textiles. Other light industries, governed more or less by the same conditions of profitability, were installed, which brought about the remarkable rate of industrialization that you see for the period before 1950 (p.50). These branches being exhausted, the domestic market of final consumption being stagnant and little varied because of the low wages, and the industries producing the means of production being too “heavy” as well in capital as in high-skilled labour to take advantage of the low wages which concern only simple and average labour, this “wave” of industrialization calmed down and as you note (p.SI), we have been witnessing since 1950 a new blockage which is, in my opinion, only a saturation of certain possibilities offered by the economic laws of profitability.

I note in passing and with pleasure a sentence on page 121 where you state that the rate of surplus value measures the relationship of power between the workers and the capitalists. This is my most intimate conviction.

I also fully agree with your developments on pages 124 and following, where you note, as I did myself, on the one hand that the overall social interest requires taking into account not only socially necessary labour, but also the “time” factor and other natural resources, in a word, all the factors of production of use values, on the other hand, that in an integrated society, the maximization of the product will be done according to the quantities of these factors required for each production, whereas in a competitive society, the choice of investments is made according to the remuneration of the factors, which, obviously, cannot lead to the social optimum.

In this context, I ask you to reflect on the famous problem of the transformation of values into production prices, which was discussed at the meeting at Anthropos. In my opinion, this is an impossible problem, since it contains a leap between two ‘antinomic’ principles, the quantities of the factors (or rather the quantity of the; single factor), on the one hand, and the remunerations of the two factors on the other. It is also a false problem since this “transformation” claims to account for the functioning of the capitalist system, whereas in this system the physical quantities of the factor(s) cannot play any determining role, the determining element being, not the social cost, but the cost of the unit of production, whether this unit is the independent merchant producer or the capitalist-employer. You have argued at Anthropos that the formal (mathematical) solution of the problem is possible. I would like you to give it to me on a numerical example, namely that of Bortkiewicz:

- VALUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

This solution is unacceptable because it excludes from the “transformation” constant and variable capital, and the calculation of the average rate of profit is based on organic compositions, not as ratios of hours of work, but as ratios of prices, The two ratios are not equal.

Transformation into producer prices according to; Rortkiewiecz î

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

But this solution is also unacceptable, because (a) the total of the values (875) does not equal the total of the

production price (1.000). This would not matter if the unit of price were not considered identical to the unit of value, (Bortkiewiecz states that it is), if there were a simple change of scale, so that the unit of price is 875/1000 units of value, that is, if the fundamental relations which must be preserved through the transformation were preserved. But they are not. Thus: (b) the overall organic composition of social capital, which was 375/300, becomes 480/320, and (c) what is much more serious, the rate of exploitation, according to which capitalists and workers share the “added value” is no longer the same. It was 20/30, that is, twenty shares for the capitalists against thirty for the workers. It has become 20/32, i.e., twenty shares for the capitalists against thirty-two for the workers, while the “transformation” of values into prices of proudction has per se no influence on the rate 1 according to which capitalists and workers share an undifferentiated purchasing power. The rate of exploitation has been reduced by the “transformation”, which is absurd.

Could you apply your own solution on the numerical example in question and satisfy the requirement of simultaneous transformation of c,v, and V, while respecting the constraints that Bortkiewiecz did not respect? Because if you do not respect these constraints your solution may be “right” from the pure mathematical point of view, but it will not be a “transformation”, that is, the maintenance of the content, the substance of the thing with modification of its form. It will be the complete abandonment of this substance, that is to say, of the material, chronometric quantity of work, of which no trace will be found. It will be the direct calculation of equilibrium prices on the basis of the ratios of the remunerations of the factors, such as are “deducible” from the absolute figures of the first scheme, but which could just as well be given as such, i.e., in relative terms, e.g., c/v -, x, v/pl = z, the absolute or separate values of c, v, and pl being indifferent. This is what Bortkiewiecz actually did, and his solution is not mathematically erroneous either, but in this “solution” the labour-value becomes a superfluous concept and one can no longer speak of “transformation”. I believe that this is the very type of logical impasse and I can’t explain otherwise the fact that for as long as this discussion has been going on, it is difficult to find two Marxists who agree on this subject.

To Pope 282 you say that there are underdeveloped countries even among those with an annual per capita income of more than 1,000 or 2,000 dollars! I don’t understand your statement. What are these countries?

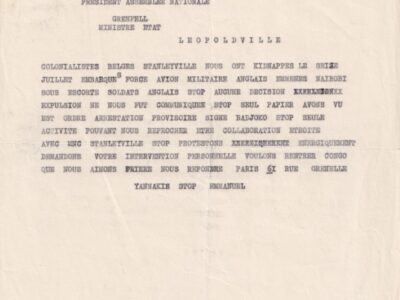

I fully agree with your analysis concerning the formation of national bourgeoisies (pp.294-295 and 302-304 . One detail: Among the factors of formation of the new commercial bourgeoisie in Uongo-Kinshasa, one is missing: The enrichment of civil servants, administrative and political, through corruption, on a scale without precedent or parallel,

I fully agree with your explanation of African state capitalism (pp. 311 & 330). The dominant class (or layer) is not a real national bourgeoisie but a bureaucracy of the state apparatus, and can only seize the means of production by nationalizing them. Lacking the financial means and the position in the relations of production that would allow it to seize private ownership of the means of production, it seizes the management of these means with all the capitalist powers that this entails. But you reject any analogy with the state capitalism of the Eastern bloc and Nazism. Are you sure about that? Don’t you think that in both cases, the bureaucracy is taking advantage of a vacuum, that the national bourgeoisie

- – 2} –

- Does it exist historically, as in the case of Africa, or is it neutralized, as in the case of Nazism, or is it expropriated, but without the means of production being truly socialized, as in the case of the countries of the East?